Cryptocurrency Regulation: What You Need to Know

When working with Cryptocurrency Regulation, the set of laws, guidelines and tax rules that govern digital assets. Also known as crypto compliance, it determines how traders, miners and businesses operate in a legal environment that changes fast.

One of the biggest drivers today is the Travel Rule, an EU‑wide requirement that forces crypto firms to collect and share full transaction data for every transfer. This rule connects directly to Cryptocurrency Regulation because platforms must build AML systems that can handle a zero‑threshold data load. Another hot topic is Stablecoin, digital tokens pegged to fiat or commodities that need clear classification as securities or commodities. The way regulators label stablecoins shapes the rules around reserve disclosures and consumer protection.

Key Areas Shaping the Landscape

Regulators also keep a close eye on FBAR, the foreign bank and financial accounts report that US taxpayers must file for overseas crypto holdings. Failure to file can trigger $100,000 penalties, so compliance teams treat FBAR as a non‑negotiable line item in their risk checklists. Meanwhile, Capital Gains Tax, the tax on profit from selling crypto assets varies wildly by jurisdiction, turning some countries into crypto havens while others impose steep rates. Understanding these tax nuances helps investors decide where to set up legal entities or hold tokens.

Putting it together, Cryptocurrency Regulation encompasses Travel Rule compliance, Stablecoin classification, FBAR reporting, and Capital Gains Tax planning. It requires tools like on‑chain analytics, KYC platforms and tax calculators. At the same time, each of those sub‑areas influences the broader regulatory outlook – for example, stricter Travel Rule enforcement pushes firms to upgrade AML tech, which in turn raises the bar for FBAR accuracy.

Below you’ll find a curated set of articles that break down these topics in depth. From the 2025 CLARITY and GENIUS Acts in the US to how Singapore avoids capital gains tax, the guides give you actionable steps, real‑world examples and a clear picture of what to expect next in the ever‑evolving world of crypto rules.

Foreign Exchange Violations for Crypto in Morocco: Rules, Penalties, and What’s Legal in 2026

Morocco lifted its crypto ban in 2025 but still enforces strict foreign exchange rules. Learn what's legal, what's banned, and how penalties work in 2026.

Crypto Exchange Licensing in Turkey: What You Need to Know in 2026

Turkey now requires all crypto exchanges to be licensed with strict capital, compliance, and ownership rules. Learn the 2026 requirements, costs, and risks of operating in Turkey's tightly controlled crypto market.

Is Crypto Regulated in India? Tax Rules, Legal Status, and What You Need to Know in 2026

Crypto is legal in India but heavily regulated. As of 2026, all digital assets are taxed at 30% with a 1% TDS on every transaction. No deductions, no loss offsets, and strict reporting rules apply. Here's what you need to know.

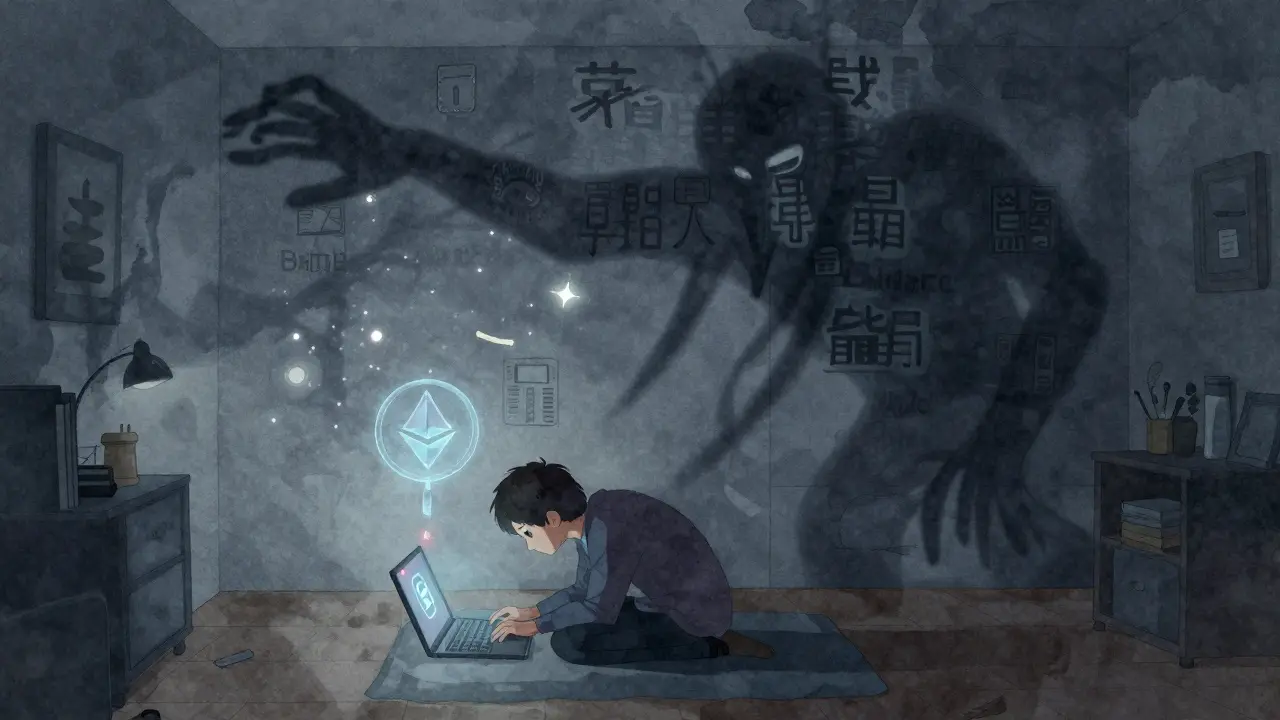

How to Buy Crypto for Fiat in China in 2026

Buying crypto with fiat in China is restricted, but possible through international exchanges and P2P platforms. Learn how to use Binance, CEX.IO, and MEXC safely in 2026 with real payment methods and fee tips.

Crypto exchanges to avoid if you are Indian

Avoid crypto exchanges that ignore India's FIU-IND rules. Binance, Bybit, and WazirX have faced penalties or hacks-leaving users with frozen funds and no legal protection. Stick to compliant platforms like CoinDCX and ZebPay.

Malta Financial Services Authority Crypto Rules: What You Need to Know in 2026

Malta's crypto rules under the MFSA and MiCA are now the strictest in Europe. Learn what licenses you need, how much it costs, and what compliance really means in 2026.

Why Trading Volume Dropped After Crypto Restrictions in 2025

Crypto trading volume dropped sharply in 2025 after new regulations forced exchanges to delist tokens and restrict users. Despite Bitcoin hitting new highs, retail activity fell as compliance changed how people traded - and who could trade at all.

Namibia Banking Restrictions on Crypto Transactions: What You Need to Know in 2025

Namibia allows licensed crypto businesses but blocks individuals from using them. Banks freeze accounts, provisional licenses delay access, and crypto remains technically illegal despite new laws. Here's what's really happening in 2025.

Namibia Banking Restrictions on Crypto Transactions: What You Need to Know in 2025

Namibia's banking system restricts crypto transactions despite the 2023 Virtual Assets Act. Banks freeze accounts, no licensed exchanges operate, and individuals face legal uncertainty. Here's what you need to know in 2025.

VPN Usage for Crypto Access in China: Legal Risks in 2025

Using a VPN to access crypto in China is illegal and risky in 2025. The government bans all private crypto activity, and VPN use to bypass restrictions can lead to fines, account freezes, or criminal charges.

VPN Usage for Crypto Access in China: Legal Risks in 2025

In 2025, China bans all private cryptocurrency use. Using a VPN to access crypto exchanges like Binance is illegal and risky. Authorities actively block VPNs, monitor transactions, and confiscate assets. The digital yuan is the only legal alternative.

Bitcoin and Ethereum ETF Approvals in the US: What Changed and What It Means for Investors

The U.S. approved spot Bitcoin and Ethereum ETFs in 2024, marking a turning point for crypto in mainstream finance. With in-kind trading now allowed, institutional adoption is surging-and fees, yields, and regulations are evolving fast.