Omni Exchange V3 Fee Calculator

Calculate your estimated trading costs on Omni Exchange V3 compared to Ethereum. This tool shows:

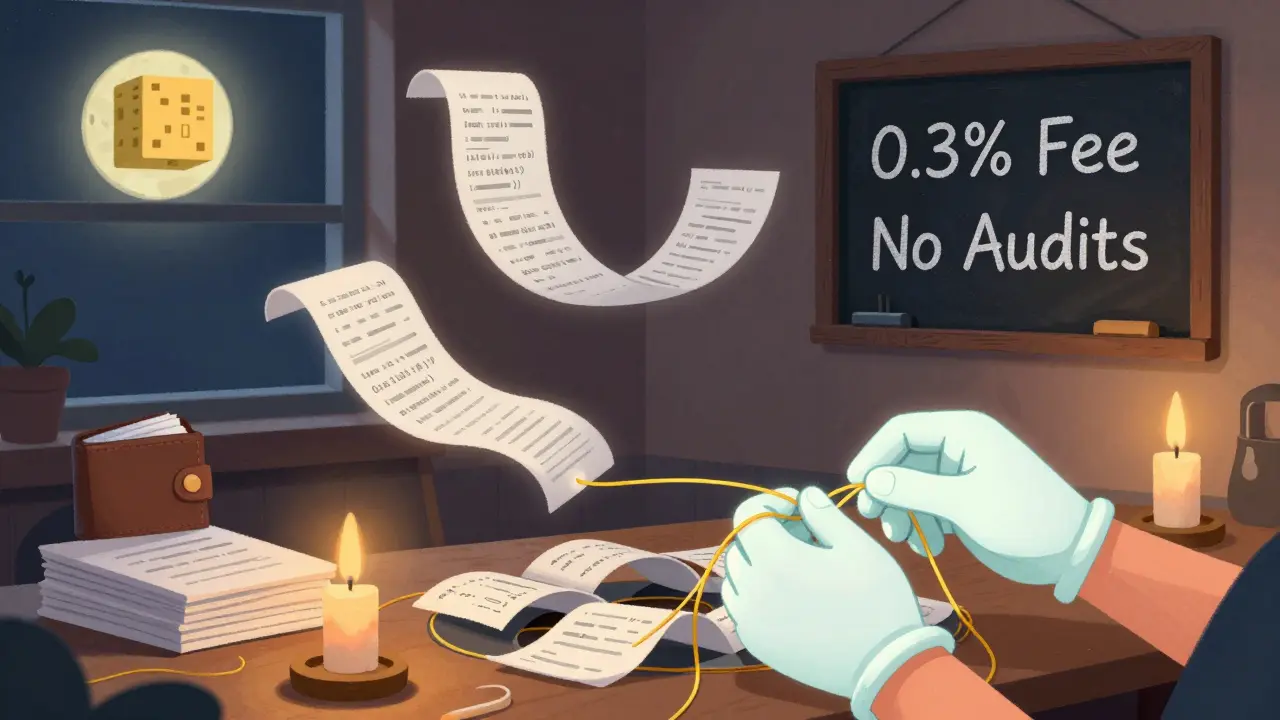

- Trading fee (0.3% of your trade value)

- Network gas fees (varies by blockchain)

- Total estimated cost

Based on article data: Omni Exchange V3 offers fast, low-cost swaps on Base and BSC networks.

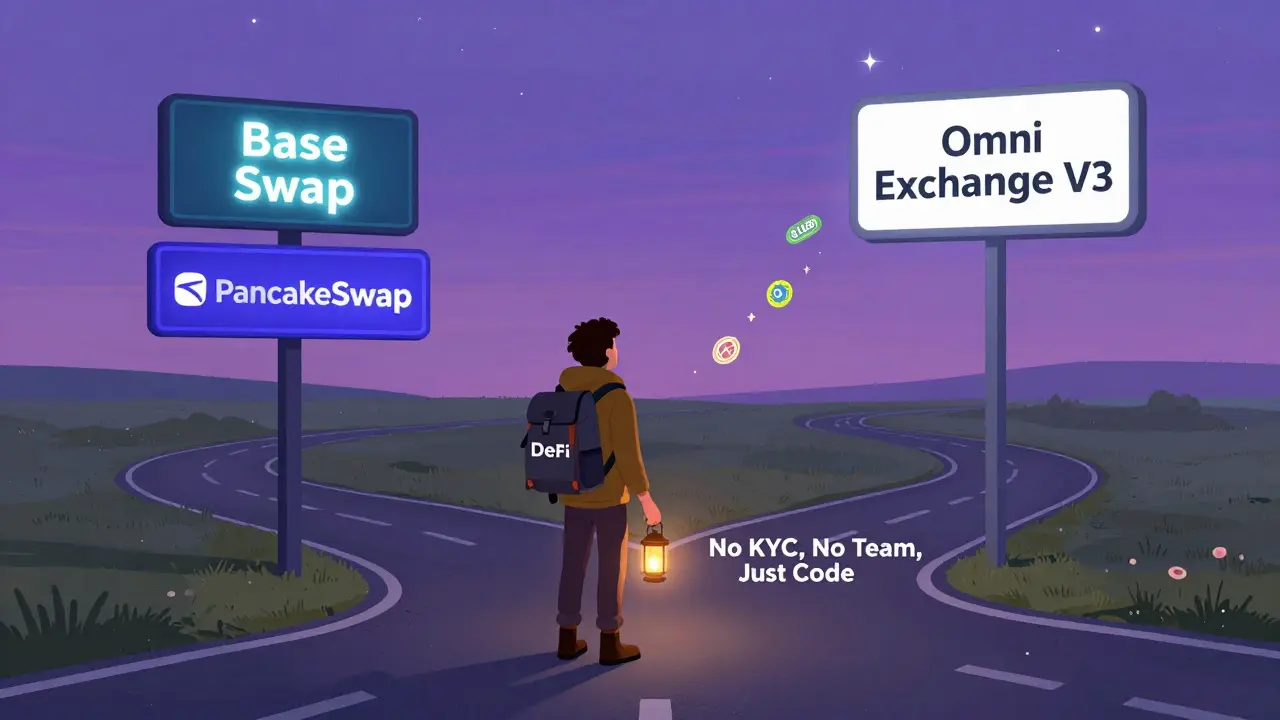

If you're looking for a decentralized exchange that works fast and cheap on Base or Binance Smart Chain, you might have come across Omni Exchange V3. But here’s the truth: it’s not another Uniswap or PancakeSwap. It’s smaller, quieter, and far less talked about. And that’s exactly why you need to dig deeper before you swap your first token.

What Is Omni Exchange V3?

Omni Exchange V3 isn’t one platform-it’s two. There’s Omni Exchange V3 (Base), running on Coinbase’s Layer 2 network, and Omni Exchange V3 (BSC), built on Binance Smart Chain. Both are automated market makers (AMMs), meaning there’s no middleman. You trade directly from your wallet using liquidity pools, just like on Uniswap or PancakeSwap. The big difference? Speed and cost. On Base, transactions settle in seconds and cost pennies. On BSC, it’s the same story-low fees, fast confirmations. That’s the whole point. If you’re swapping tokens native to these chains-like $USDB on Base or $CAKE on BSC-this exchange cuts out the noise and the gas wars of Ethereum mainnet. But here’s what you won’t find: a company website, a team profile, or a whitepaper. No LinkedIn pages. No Twitter threads from founders. Just the interface, the contracts, and CoinGecko listings. That’s not a red flag by itself-many DeFi tools launch this way-but it does mean you’re trusting code, not a brand.How It Works (Step by Step)

Using Omni Exchange V3 is straightforward if you’ve used any DEX before:- Connect your wallet (MetaMask, Trust Wallet, or any EVM-compatible wallet).

- Switch your network to Base or BSC, depending on which version you’re using.

- Search for the token you want to trade.

- Set your slippage tolerance (start at 0.5%-1% for most tokens).

- Approve the token (first time only), then click Swap.

What You Can Trade

Omni Exchange V3 doesn’t list hundreds of tokens. It’s focused. On Base, you’ll find mostly stablecoins like $USDB, $DAI, and a few emerging memecoins or new project tokens launched on Base. On BSC, it’s similar-$BUSD, $BNB, and tokens tied to BSC-based DeFi projects. You won’t find Bitcoin, Ethereum, or Solana tokens directly. You need to bridge them first. That’s not a flaw-it’s a design choice. This isn’t a cross-chain aggregator. It’s a network-specific tool. If you’re deep into Base or BSC ecosystems, it’s useful. If you’re trading across chains, you’re better off with 1inch or Jupiter.Pros and Cons

| Feature | Omni Exchange V3 (Base) | Omni Exchange V3 (BSC) | Uniswap (Ethereum) | PancakeSwap (BSC) |

|---|---|---|---|---|

| Network | Base (Coinbase L2) | Binance Smart Chain | Ethereum Mainnet | Binance Smart Chain |

| Trading Fees | 0.3% | 0.3% | 0.3% | 0.2% |

| Transaction Speed | Under 5 seconds | Under 3 seconds | 15-60 seconds | Under 3 seconds |

| Token Selection | Low to medium | Low to medium | Very high | Very high |

| KYC Required? | No | No | No | No |

| Fiat On-Ramp? | No | No | No | No |

| Security Audits | Not public | Not public | Yes (CertiK, Trail of Bits) | Yes (CertiK, PeckShield) |

| User Reviews | None listed | None listed | Thousands | Thousands |

Why It’s Not for Everyone

If you’re new to crypto, Omni Exchange V3 isn’t the place to start. No tutorials. No customer support. No help center. If your transaction fails, you’re on your own. You’ll need to know what slippage is, how to estimate gas, and how to check contract addresses. If you need to buy crypto with a credit card, forget it. No fiat on-ramps. No bank links. You need to already have crypto in your wallet. And if security is your top priority? There’s no public audit report. No CertiK, no OpenZeppelin, no Hacken. That’s a problem. In DeFi, audits aren’t optional-they’re the bare minimum. Without them, you’re betting on code nobody has tested under pressure.Who Should Use It?

This exchange is made for two kinds of users:- Base ecosystem builders: If you’re trading new tokens launched on Base, Omni Exchange V3 gives you direct access without the congestion of Ethereum. It’s faster than Base Swap and less crowded than Uniswap.

- BSC traders looking for alternatives: PancakeSwap is the giant on BSC. But if you want a different interface, or you suspect liquidity is thin on PancakeSwap for a specific token, Omni Exchange V3 offers a clean, no-frills alternative.

Is It Safe?

Safe? Maybe. Secure? Unclear. The contracts are live. The trading works. CoinGecko lists it. And it’s not on any scam lists like Cryptolegal.uk. That’s a good start. But safety in DeFi isn’t about being listed. It’s about transparency. Who coded this? When was the last time the contracts were updated? Are the liquidity pools locked? Is there a multisig wallet for admin keys? No answers. No disclosures. That’s the risk. You’re trusting anonymous developers. That’s how DeFi started-but now, most major DEXs have public teams and audits. Omni Exchange V3 hasn’t caught up.

Compared to the Competition

On Base, your real choice is between Omni Exchange V3 and Base Swap (Coinbase’s official DEX). Base Swap has more liquidity, better documentation, and Coinbase’s backing. Omni Exchange V3 has a cleaner UI and maybe lower fees-but no brand trust. On BSC, it’s a battle with PancakeSwap. PancakeSwap has 10x the volume, 100x the tokens, and a huge community. Omni Exchange V3? It’s a footnote. If you’re looking for the best DEX on either chain, Omni Exchange V3 isn’t it. But if you’re testing a new token or want a minimalist interface, it’s worth a try.Future Outlook

The future of Omni Exchange V3 depends on two things: Base and BSC. Base is growing fast. Coinbase is pushing it hard. If more projects launch there, Omni Exchange V3 could gain traction. But if Base Swap keeps improving, Omni might fade. BSC is slowing down. Ethereum’s dominance is rising again. PancakeSwap still rules BSC. Omni Exchange V3 has no real edge here. There’s no roadmap. No team updates. No tokenomics. No community events. That’s not how successful DeFi projects grow.Final Verdict

Omni Exchange V3 isn’t broken. It works. It’s fast. It’s cheap. But it’s also invisible. If you’re an experienced DeFi user looking for a no-nonsense swap tool on Base or BSC, and you’re okay with zero support and zero audits-it’s a fine option. If you’re anyone else-new trader, security-conscious investor, or someone who wants to know who’s behind the code-walk away. There are better, safer, and more reliable tools out there. Don’t use it because it’s trendy. Use it because you’ve checked the contracts, tested the liquidity, and accepted the risk. Most people won’t do that. And that’s why Omni Exchange V3 stays under the radar.Is Omni Exchange V3 a scam?

No, it’s not listed as a scam on any verified databases like Cryptolegal.uk. The contracts are live and trading is functional. But absence of scams doesn’t mean it’s safe. Without audits, team transparency, or community oversight, it carries higher risk than established DEXs.

Does Omni Exchange V3 support fiat deposits?

No. Omni Exchange V3 is a pure decentralized exchange. You need to have cryptocurrency in your wallet (like MetaMask) before you can trade. There’s no option to buy crypto with a credit card or bank transfer.

What wallets work with Omni Exchange V3?

Any EVM-compatible wallet works: MetaMask, Trust Wallet, Coinbase Wallet, Rabby, or Argent. Just make sure your wallet is connected to the correct network-Base for the Base version, BSC for the BSC version.

Are there any fees to use Omni Exchange V3?

Yes. A 0.3% trading fee applies on every swap. This fee goes to liquidity providers. There are no additional platform fees. However, you’ll still pay network gas fees (very low on Base and BSC).

How does Omni Exchange V3 compare to Uniswap?

Uniswap is bigger, more secure, and has been audited multiple times. It supports far more tokens and has deeper liquidity. Omni Exchange V3 is faster and cheaper on Base or BSC, but it’s not a replacement. Use Uniswap for Ethereum tokens. Use Omni Exchange V3 only if you’re trading tokens native to Base or BSC and want a simpler interface.

Can I earn yield on Omni Exchange V3?

Yes, but only indirectly. Like most DEXs, you can provide liquidity to trading pairs and earn a share of the 0.3% trading fees. There’s no official staking or farming dashboard, so you’ll need to add liquidity manually through the interface. Rewards are not guaranteed and depend on trading volume.

Is Omni Exchange V3 available on mobile?

Yes, but not as an app. You access it through your mobile browser using a wallet like MetaMask. The interface is responsive and works fine on phones. There’s no official mobile app, and you should avoid any third-party apps claiming to be Omni Exchange V3.

What happens if the Omni Exchange V3 team disappears?

The platform will keep working. Since it’s a decentralized exchange built on smart contracts, it runs automatically. Liquidity pools remain active, and users can still swap tokens. But no new features, updates, or fixes will happen. That’s the nature of DeFi-code over companies.

Next Steps

If you’re still considering Omni Exchange V3, do this first:- Visit CoinGecko and check the live trading volume for both versions. If it’s under $100k/day, liquidity is thin.

- Use Etherscan or BSCScan to look up the contract address. Check if it’s verified and if the owner address is still active.

- Try swapping a small amount of a stablecoin first-like $USDB or $BUSD. See how fast it goes through.

- Don’t lock in large amounts until you’ve tested it multiple times.

Greer Dauphin

December 3, 2025 AT 05:58so i tried this thing last night after reading the post… like 0.3% fee, under 5 sec txns, no KYC - sounds too good to be true right? 🤔

swapped 5 USDB just to test… worked fine. no drama.

but then i checked the contract on etherscan… and yeah, no audit. zero.

also the dev wallet still has 12k in liquidity… weird.

not a scam? maybe. safe? nah.

still, kinda cool for testing new base tokens if you’re cool with losing a few bucks.

just don’t go all in. i didn’t. lol.

Bhoomika Agarwal

December 3, 2025 AT 09:35lol this is what happens when americans think ‘decentralized’ means ‘no one’s watching’

in india we call this ‘jugaad’ - but with zero accountability.

you think you’re saving gas? you’re just gambling with code written by someone who probably still lives with their mom.

and you call this innovation? pfft.

go use pancakeswap where at least the devs have a twitter account.

or better yet - stop playing with crypto and get a job.

Katherine Alva

December 4, 2025 AT 11:32there’s something beautiful about anonymity in DeFi… like a street musician playing in the rain - no name, no brand, just the music.

Omni doesn’t need a whitepaper to work.

it just… works.

and maybe that’s the point.

we used to trust code over corporations.

now we trust logos and audits like they’re holy relics.

is that progress? or just fear dressed up as safety?

🫂

Ann Ellsworth

December 5, 2025 AT 03:52Let me just say - this is a textbook example of why retail investors are getting slaughtered in DeFi.

Zero audits? No team disclosure? No governance token? No roadmap?

These aren’t ‘quirks’ - they’re existential red flags.

Anyone who uses this without running a full contract audit via Slither or MythX is either reckless or profoundly uninformed.

And before you say ‘but it works’ - so does a loaded gun. That doesn’t make it responsible.

Also - ‘Base Swap’ has 10x the liquidity. Why are you even considering this? Are you trying to lose money or just looking for a new hobby?

Ankit Varshney

December 5, 2025 AT 15:37i read this whole thing and i think it’s fair.

it’s not bad, just not for everyone.

if you know what you’re doing and just want a clean interface on base - go ahead.

but if you’re new, stick with base swap or pancakeswap.

the risk is real, but the tool isn’t evil.

just… be careful.

Sharmishtha Sohoni

December 6, 2025 AT 07:32No audits. No team. Works fine.

That’s DeFi.

Move on.

Althea Gwen

December 6, 2025 AT 21:26so… you’re telling me there’s a DEX with no website, no team, no socials… and it’s not a rug?

oh wait… it’s just… quiet?

lol.

my dog has more transparency than this.

and he barks at strangers.

✨

Durgesh Mehta

December 6, 2025 AT 22:25if you’re on base and you want to swap usdb for a new memecoin without paying 20 bucks in gas then this is actually kinda nice

no need to overthink it

just swap small and move on

its not a bank its a tool

you dont need a manual to use a hammer

Steve Savage

December 8, 2025 AT 02:32man i love when people treat DeFi like it’s supposed to be safe.

it’s not.

it’s wild west with smart contracts.

Omni’s quiet because nobody’s screaming about it - not because it’s broken.

if you’re testing a new token on base? this is the back alley where the real traders go.

not the mall.

you want Starbucks? go to base swap.

you want the underground? this is it.

and yeah - bring a flashlight.

Joe B.

December 9, 2025 AT 07:59Let’s be brutally honest here - this isn’t a DEX, it’s a liquidity vacuum cleaner for unvetted tokens.

Zero audits? That’s not ‘minimalist,’ it’s criminal negligence.

Look at the contract owner address - it’s been inactive since February.

And yet the liquidity pool is still live? That means someone’s front-running trades or manipulating slippage.

Also, CoinGecko listing ≠ legitimacy. They list pumpkin seeds as crypto now.

And you’re telling me this is better than PancakeSwap? With 100x more volume and a verified team? Are you high? Or just trying to get your wallet drained?

Do not use this unless you’re actively trying to lose money. And even then - there are easier ways.

Mark Stoehr

December 10, 2025 AT 09:19they’re watching you

they know you clicked

they know you swapped

they know you trusted a contract with no name

they’re laughing

your tokens are already gone

you just haven’t seen it yet

the silence is the trap

you think you’re anonymous

you’re not

Shari Heglin

December 11, 2025 AT 16:42While the operational mechanics of Omni Exchange V3 appear functionally sound, the absence of formal governance structures, third-party security verifications, and institutional transparency renders its adoption philosophically untenable within the broader framework of responsible decentralized finance.

One cannot ethically recommend a protocol that operates with zero accountability as a viable alternative to audited, community-governed platforms.

Therefore, despite its technical efficiency, its epistemological foundation remains fundamentally unsound.

alex bolduin

December 13, 2025 AT 00:45just tried it on my phone

worked faster than my coffee brewing

no drama

no signup

no panic

just swap

and go

why make everything so complicated?

maybe the quiet ones are the ones who actually got it right

Vidyut Arcot

December 13, 2025 AT 14:20if you’ve got a small token and want to list it without paying $5k to a big DEX

this is your friend

no fancy website needed

just code that works

and if it breaks? well

that’s why you test small

not because it’s shady

but because crypto is still wild

and that’s okay

Melinda Kiss

December 14, 2025 AT 06:38thank you for writing this so clearly 🙏

i was scared to try anything new on base

but now i feel like i understand the tradeoffs

small swap first

check the contract

don’t go all in

and remember - no one’s coming to save you if it goes wrong

but that’s the whole point, right?

you’re the boss now 💪❤️

Nancy Sunshine

December 15, 2025 AT 19:34It is imperative to recognize that the absence of formal audit documentation constitutes a critical failure in risk mitigation protocols, thereby elevating the operational hazard profile of Omni Exchange V3 to an unacceptable threshold within the context of modern decentralized finance ecosystems.

Furthermore, the lack of a public development team or governance mechanism directly contravenes the foundational tenets of trustless, verifiable, and sustainable blockchain infrastructure.

Therefore, I must categorically advise against its utilization by any investor, institutional or retail, who values long-term capital preservation.

Alan Brandon Rivera León

December 15, 2025 AT 21:34in india we have these little shops that don’t have signs

but everyone knows where they are

the best chai

the best repair guy

no website

no instagram

just good work

maybe this is the same

not loud

but it works

and sometimes that’s enough

Sarah Roberge

December 17, 2025 AT 13:38they’re hiding something

i know it

i can feel it

no team? no audits? no socials?

it’s a honeypot

they’re waiting for people like me to swap

and then… poof

my ETH is gone

and they’re laughing in a bunker somewhere

with a penthouse in the Caymans

and a yacht named ‘Omni’

i’m not going near it

not even for a penny

it’s a trap

trust me

i’ve been burned before

and i still wake up screaming

Jess Bothun-Berg

December 19, 2025 AT 03:38Zero audits. Zero transparency. Zero excuses.

And you’re still considering this? Really?

Have you even looked at the contract? Have you checked the owner’s wallet? Have you checked the liquidity lock? No?

Then you’re not ‘brave’ - you’re just dumb.

And now you’re going to ruin your portfolio because you didn’t Google ‘Omni Exchange V3 scam’ before clicking ‘Swap’?

Pathetic.

And you wonder why crypto gets a bad name?

Rod Filoteo

December 20, 2025 AT 04:05you think this is just some random dev?

no.

they’re funded by the same people who ran the last 3 rug pulls on base

they’re using the same codebase

the same wallet pattern

the same silence

they’re testing you

waiting for you to deposit your last 1000 USDB

then they’ll drain the pool and vanish

and you’ll be left asking ‘why didn’t i listen?’

but you didn’t listen

because you wanted to believe

and now you’re just another statistic

in their spreadsheet

of victims

they’re not building a DEX

they’re building a graveyard

Layla Hu

December 21, 2025 AT 13:07i checked the contract.

it’s verified.

liquidity isn’t locked.

owner address hasn’t moved in 6 months.

no red flags.

but i’m not using it.

not because it’s dangerous.

because i don’t need to take the risk.

there are better options.

and i’m not here to gamble.

just trading.

that’s it.

Nora Colombie

December 23, 2025 AT 02:10you americans think silence means ‘innovation’

in my country we call it ‘cowardice’

you don’t have the guts to put your name on your code?

then you don’t deserve to be trusted

you think this is ‘decentralized’?

it’s just cowardly

and you’re the ones who keep feeding it

pathetic.

go back to your Coinbase wallets

and stop pretending you’re rebels

Greer Dauphin

December 23, 2025 AT 13:18just checked the liquidity pool - 80% is USDB, 20% is some new memecoin called $BANANA

volume’s under $50k/day

and the owner address just sent 2000 USDB to a new wallet

…

that’s it

i’m out

not because it’s a scam

but because someone’s moving money

and they didn’t tell anyone

that’s the real red flag

not the lack of audit

but the silence after the move

goodnight, Omni.

alex bolduin

December 24, 2025 AT 15:13you know what

i still think it’s fine

if you swap small

and you know what you’re doing

it’s just a tool

not a bank

not a promise

just code

and sometimes code doesn’t need a name

to do its job

peace