As of 2025, if you're trying to use Bitcoin or any other cryptocurrency in Namibia, you're walking a tightrope. The country doesn't outright ban crypto - but its banks? They're making it as hard as possible. You can't buy crypto with your NedBank account. You can't send money to a local exchange without risking your account being frozen. And if you're running a crypto business? You're stuck in a legal gray zone that’s still being sorted out - even after new laws were passed.

Why Banks Won’t Touch Crypto

The Bank of Namibia (BON) made its stance clear back in 2018: cryptocurrencies aren’t legal tender. They’re not money. They’re not commodities. And if you lose money trading them, tough luck - the bank won’t help you. That warning wasn’t just a footnote. It became the foundation for how banks treat crypto users today. Major banks like NedBank and Standard Bank have quietly started flagging and restricting accounts tied to crypto activity. People running crypto investment clubs, buying Bitcoin on peer-to-peer platforms, or even just holding digital assets have reported sudden account freezes. No warning. No explanation. Just a message saying their account is under regulatory review. Legal experts say this is a problem. The Bank of Namibia doesn’t have the power to make laws. Only Parliament can do that. Yet, the bank is acting like it does - using its control over the banking system to enforce a policy that’s not written in law. That’s why some lawyers are calling it an overreach. If BON thinks crypto is risky, they should go to court. Instead, they’re using bank account access as leverage.The Virtual Assets Act of 2023: A Step Forward - But Not Enough

In June 2023, Namibia passed the Virtual Assets Act (Act No. 10 of 2023). This was the country’s first real attempt to regulate digital assets. It created a licensing system for Virtual Asset Service Providers (VASPs) - companies that offer crypto trading, wallet services, or exchange platforms. These businesses now have to register with NAMFISA, the financial watchdog, and follow strict anti-money laundering rules. One big requirement? The Travel Rule. Any crypto transaction over NAD 20,000 (about $1,000 USD) must include full sender and receiver details - names, ID numbers, bank account info. That’s the same rule used in the EU and U.S. It’s meant to stop criminals from hiding behind anonymity. But here’s the catch: the law applies to businesses, not individuals. So if you’re buying Bitcoin from a friend in Windhoek? No one’s checking your ID. But if you’re using a local exchange? They’re required to log everything.

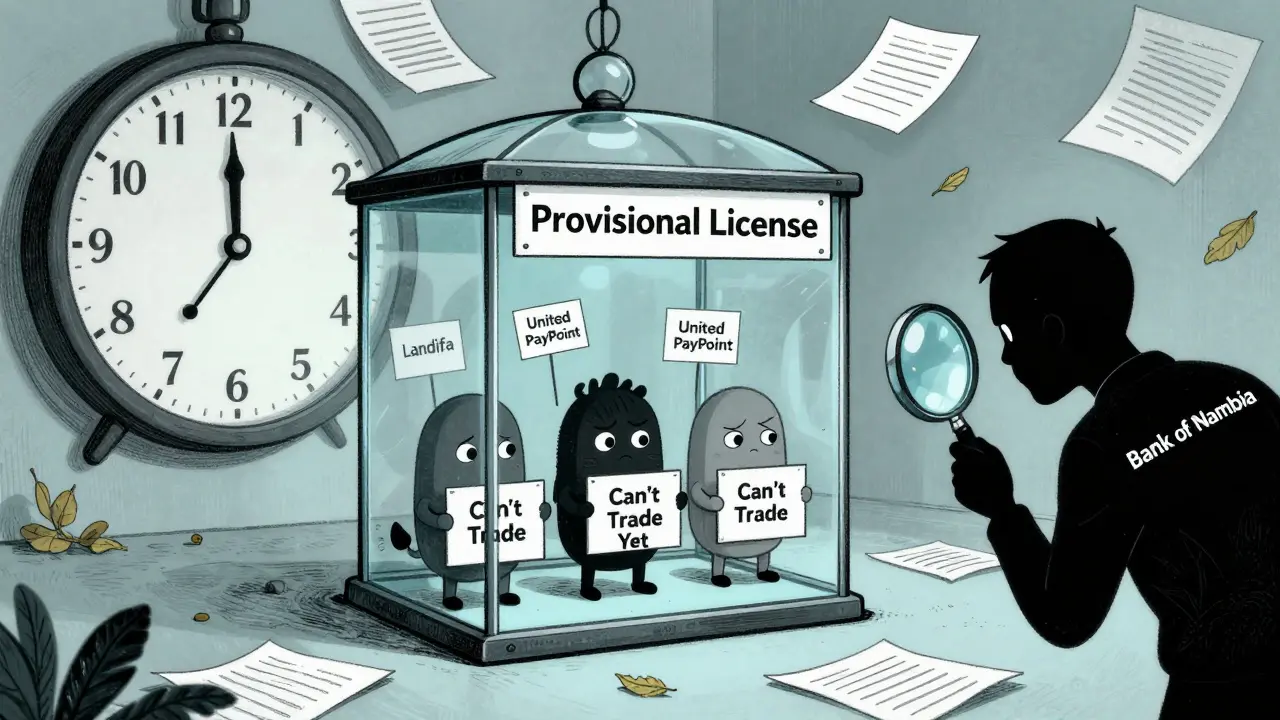

The Provisional License Trap

Here’s where things get messy. Even though the law passed in 2023, no crypto exchange has been allowed to operate openly in Namibia yet. In January 2025, the Bank of Namibia gave provisional licenses to three companies: Landifa Bitcoin Trade CC, United PayPoint (Pty) Ltd, and Mindex Virtual Asset Exchange. But here’s the twist - they’re not allowed to do business. Not with anyone. Not even one transaction. These companies are stuck in a six-month testing period. They can’t serve customers. They can’t accept deposits. They can’t even advertise. Their only job? Build systems, hire staff, and prove they can meet every single compliance requirement. The bank is watching closely. If they mess up, the license gets pulled. Two of the three companies asked for extensions. Landifa got until July 31, 2025. United PayPoint until May 13, 2025. Mindex got until November 21, 2025. That’s more than a year after the law passed. And still, no one can legally trade crypto in Namibia. The Bank of Namibia says this is about safety. But for businesses, it’s a waiting game with no clear finish line. And for regular people? It’s proof that even if the law says crypto is regulated, the banks still won’t let you use it.What About Individual Users?

If you’re just holding Bitcoin or trading on Binance or Kraken from your phone, you might think you’re fine. But you’re not. Banks monitor transactions. If you send money to a foreign crypto exchange, even once, your account could get flagged. Some users report being asked to prove the source of funds - even if they’re just selling a few Bitcoin they bought years ago. If they can’t prove it, the bank freezes the account. No appeal. No hearing. There’s no official list of banned crypto activities. No public guidance. So people are left guessing. Is it illegal to own Bitcoin? No. Is it illegal to trade it? Technically, yes - because there’s no licensed platform to do it legally. Is it illegal to send money to a foreign exchange? The law doesn’t say. But banks are treating it like it is. This uncertainty is scaring people away. Some are closing their crypto wallets. Others are moving their money offshore. A few are using cash or peer-to-peer deals - but those come with their own risks: scams, no buyer protection, and no recourse if things go wrong.

Rishav Ranjan

December 24, 2025 AT 20:43Why bother?

Jacob Lawrenson

December 26, 2025 AT 16:14Bro this is wild 😱 I just moved to Namibia and thought I could crypto-hustle like back home. Nope. My NedBank account got frozen after I bought 0.02 BTC on Binance. No warning. No email. Just a notice saying 'regulatory review'. Now I'm using cash for P2P trades. Scary stuff.

Vijay n

December 28, 2025 AT 04:11Bank of Namibia is just a puppet of western financial interests they dont want Africans to be financially independent thats why they block crypto its all about control

Janet Combs

December 29, 2025 AT 15:03i dont get why its such a big deal to just let people trade crypto... like if you dont wanna do it dont do it but why make it hard for everyone else? i feel like the banks are just scared of change and theyre using 'risk' as an excuse

Mmathapelo Ndlovu

December 30, 2025 AT 09:51As a South African, I see this and I'm heartbroken. We've got regulated exchanges, crypto ATMs, even crypto taxes that make sense. Namibia had a chance to lead and now it's stuck in bureaucratic limbo. 🫂

Sheila Ayu

December 30, 2025 AT 10:46Wait... so you're telling me that the law says crypto is legal... but banks are making it illegal? That's not regulation. That's tyranny. And the fact that they're giving provisional licenses but not letting them operate? That's not oversight. That's sabotage. And I'm not even mad... I'm just disappointed.

Lloyd Yang

December 31, 2025 AT 22:06Let me break this down for you like you're five: Imagine you're trying to open a lemonade stand. The city passes a law saying lemonade stands are legal, gives you a permit, even tells you how to make the lemonade safe. But then every single water supplier in town refuses to sell you water unless you prove you're not selling 'suspicious lemonade'. So you sit there with a sign that says 'Open for Business'... but no water, no cups, no customers. That's Namibia's crypto scene right now. The law exists. The infrastructure is being built. But the system is sabotaging itself. And the worst part? The people who want to play fair are the ones getting punished.

Sarah Glaser

January 2, 2026 AT 18:33The regulatory ambiguity in Namibia presents a profound paradox: legislative intent versus institutional inertia. While the Virtual Assets Act of 2023 provides a robust legal framework for licensing, the Bank of Namibia's de facto prohibition through banking restrictions undermines the very sovereignty of law. This is not merely policy inconsistency-it is institutional overreach masquerading as prudence. The consequence? A chilling effect on innovation, capital formation, and financial inclusion. The state must choose: enforce the law, or become its adversary.

Jordan Renaud

January 3, 2026 AT 11:40I get why the banks are nervous. Crypto is wild. But punishing honest people because some bad actors exist? That’s like banning all cars because someone drove drunk. The law already covers fraud and money laundering. Why not just enforce it? Instead, they’re building a wall around innovation and calling it safety. Sad.

Luke Steven

January 4, 2026 AT 12:00It's not about crypto being dangerous. It's about control. The moment people can move money without banks, the banks lose power. And they'd rather lock everyone out than risk losing a little control. The Virtual Assets Act was a gift. They're returning it with a brick to the face.

Ellen Sales

January 5, 2026 AT 18:02so the law says 'you can do this'... but the banks say 'you cant'... and the government says 'we'll see'... so technically, is crypto legal in namibia? or is it like... legally confused? 🤔

Charles Freitas

January 7, 2026 AT 06:42Oh wow, a country trying to regulate crypto? How quaint. Let me guess-next they'll start requiring people to wear helmets when riding bicycles. This is the kind of overregulation that kills innovation before it even takes its first breath. The fact that they're not even letting licensed entities operate? Pathetic.

roxanne nott

January 9, 2026 AT 00:25Provisional licenses with no activity allowed? That’s not a license. That’s a joke. And the delays? Mindex gets until November? That’s 20 months after the law passed. They’re not regulating. They’re stalling. And the people paying the price? Everyday citizens. Not the rich. Not the connected. Just normal people trying to build wealth.

Collin Crawford

January 9, 2026 AT 00:40It is imperative to note that the Bank of Namibia, as a central banking institution, possesses the fiduciary responsibility to preserve monetary stability. The absence of a universally accepted valuation mechanism for virtual assets renders them inherently incompatible with the national financial architecture. The legislative framework, while well-intentioned, is premature. Prudence, not populism, must guide policy.

Tyler Porter

January 9, 2026 AT 02:41Man, I just want to buy some Bitcoin without my bank freezing me. Is that too much to ask? I’m not laundering money. I’m not scamming anyone. I just want to invest. Why does this have to be so hard?

Rebecca F

January 10, 2026 AT 20:05People are acting like this is a tragedy. Newsflash: crypto is a gamble. If you lose money, you lose money. The banks aren't the villains-they're the adults trying to keep the house from burning down. Stop romanticizing decentralization. It's not freedom. It's chaos with better branding.

vaibhav pushilkar

January 11, 2026 AT 14:20Just use P2P. LocalBitcoins, Paxful. No bank needed. Cash in hand. Simple. No drama.

SHEFFIN ANTONY

January 13, 2026 AT 13:22Oh here we go again. Another country trying to 'regulate' crypto. You know what happens when you regulate something that's supposed to be decentralized? You kill it. And then you wonder why no one innovates in your country. Classic.

Dan Dellechiaie

January 14, 2026 AT 21:24Let me be clear: the Bank of Namibia is not protecting citizens. It is protecting its own monopoly. Crypto is a threat to their rent-seeking behavior. They don't want you to have financial autonomy. They want you dependent. And they're using 'risk' as a cudgel to maintain control. This isn't regulation. It's financial apartheid.

Radha Reddy

January 15, 2026 AT 04:11I appreciate the intent behind the law, but the implementation feels like a missed opportunity. If the goal is financial inclusion, then why not partner with the licensed VASPs to create public education campaigns? Instead, we have silence, confusion, and fear. The people are being left in the dark while the bureaucracy takes its time.

Shubham Singh

January 16, 2026 AT 15:28Everyone complaining about the banks? Wake up. If you were smart, you'd be holding Bitcoin in a hardware wallet and never touching a bank account. This isn't a banking problem. It's a personal responsibility problem. You brought this on yourself.

Zavier McGuire

January 18, 2026 AT 08:25crypto is a scam and everyone who buys it is a fool

Sybille Wernheim

January 18, 2026 AT 20:55Hey, if you're using crypto in Namibia and you're scared? You're not alone. But you're also not powerless. Talk to your local VASP hopefuls. Write to NAMFISA. Share your story. Change doesn't happen because someone in a suit decides to be nice. It happens because enough people say, 'enough.' You got this 💪

Tristan Bertles

January 19, 2026 AT 07:28I've been watching this whole situation unfold from afar. And honestly? It’s heartbreaking. Namibia had a real shot at being the model for African crypto regulation. They wrote a good law. They identified the risks. They even set up a licensing system. But then... they just stopped. Like a runner who’s halfway through the race and just sits down. The provisional licenses? They’re not a step forward-they’re a trap. The banks aren’t just refusing to cooperate. They’re actively sabotaging the only legal path forward. And the worst part? The people who need this the most-small business owners, remittance senders, young entrepreneurs-are the ones getting crushed under the weight of bureaucratic cowardice. It’s not about safety. It’s about control. And it’s costing Namibia its future.

Steve B

January 20, 2026 AT 11:59One must question the motives behind this regulatory paralysis. Is it truly about financial stability, or is it about preserving the hegemony of traditional banking institutions? The absence of clear communication from authorities fosters an environment of uncertainty, which in turn stifles economic activity. This is not prudence-it is stagnation dressed in the language of caution.