SHA-256 Hash Generator

How Blockchain Hashes Work

Blockchain uses hash functions to create digital fingerprints of data. Even a tiny change creates a completely different hash. This makes tampering obvious - any alteration would break the chain.

Try entering text below to see how SHA-256 (used by Bitcoin) generates a fixed-length hash. Notice how changing one character creates a completely different output.

Try changing one character in your input and see how the hash changes completely.

When you send Bitcoin from one wallet to another, no bank approves it. No middleman checks your balance. So how does the network know you own the money-and that no one else can steal it? The answer isn’t magic. It’s cryptographic encryption.

Why Cryptography Is the Backbone of Blockchain

The word "crypto" in cryptocurrency doesn’t come from "crypt" or "hidden." It comes from cryptography-the science of securing information using math. Without it, blockchain wouldn’t work. Satoshi Nakamoto didn’t invent blockchain to make money. He built it to solve two problems: how to prove you own digital money, and how to stop someone from spending the same coin twice. Both rely entirely on encryption. Think of it like a digital safe. Your Bitcoin isn’t stored in a server somewhere. It’s tied to a key. That key is created using cryptography. If you lose it, your coins are gone forever. If someone steals it, they own your money. That’s why understanding how encryption works in blockchain isn’t just technical-it’s survival.The Three Pillars of Blockchain Encryption

Blockchain doesn’t use one encryption method. It uses three that work together like gears in a clock.- Hash Functions - These turn any piece of data-whether it’s a sentence, a photo, or a transaction-into a fixed-length string of letters and numbers. Bitcoin uses SHA-256. Change one letter in your transaction? The hash changes completely. This makes tampering obvious. Every block in the chain contains the hash of the one before it. If someone tries to alter an old transaction, they’d have to recalculate every single hash after it. On a network with millions of blocks? Impossible.

- Asymmetric Cryptography (Public and Private Keys) - This is how you prove you own your Bitcoin. You have two keys: a public one, which is like your bank account number, and a private one, which is like your PIN. Anyone can see your public key. Only you have the private key. When you send Bitcoin, you sign the transaction with your private key. The network checks that signature using your public key. If it matches, the transaction is valid. No one else can fake it.

- Digital Signatures - These are the result of combining your private key with the transaction data. A digital signature proves three things: that you authorized the transaction (authenticity), that the transaction hasn’t been changed after you signed it (integrity), and that you can’t later say you didn’t send it (non-repudiation). This is what makes blockchain trustless. You don’t need to trust the other person. You just need to trust the math.

How It All Connects: A Real Transaction

Let’s say you send 0.5 BTC to a friend. First, your wallet creates the transaction details: who’s sending, who’s receiving, how much. Then, it runs that data through SHA-256 to create a unique fingerprint. Next, your wallet uses your private key to sign that fingerprint. That signature becomes part of the transaction. The transaction gets broadcast to the network. Miners pick it up. They check: Is the signature valid? Does the public key match the private key used to sign? Is the sender actually holding those 0.5 BTC? If all checks pass, the transaction is added to a block. That block gets hashed. That hash gets added to the next block. And so on. Once confirmed, that transaction is frozen in place. No one-not even the miner who added it-can change it. Not without breaking the entire chain.

Blockchain vs. Traditional Encryption

Traditional systems-like your bank’s database or cloud storage-rely on centralized control. They use encryption too, but the data can be edited, deleted, or overwritten. If the server gets hacked, your records are at risk. Blockchain flips that. There’s no central server. Data is copied across thousands of computers. Every change is locked in with cryptographic links. If someone tries to alter one block, they’d need to control more than half the network’s computing power to rewrite the chain. That’s called a 51% attack-and it’s extremely expensive and rare on major blockchains like Bitcoin. But here’s the catch: blockchain encryption protects the chain, not your keys. If you store your private key on a phone with a virus, or write it on a sticky note, you’re not protected by blockchain. You’re protected by your own habits.Real Risks: Where Blockchain Encryption Fails

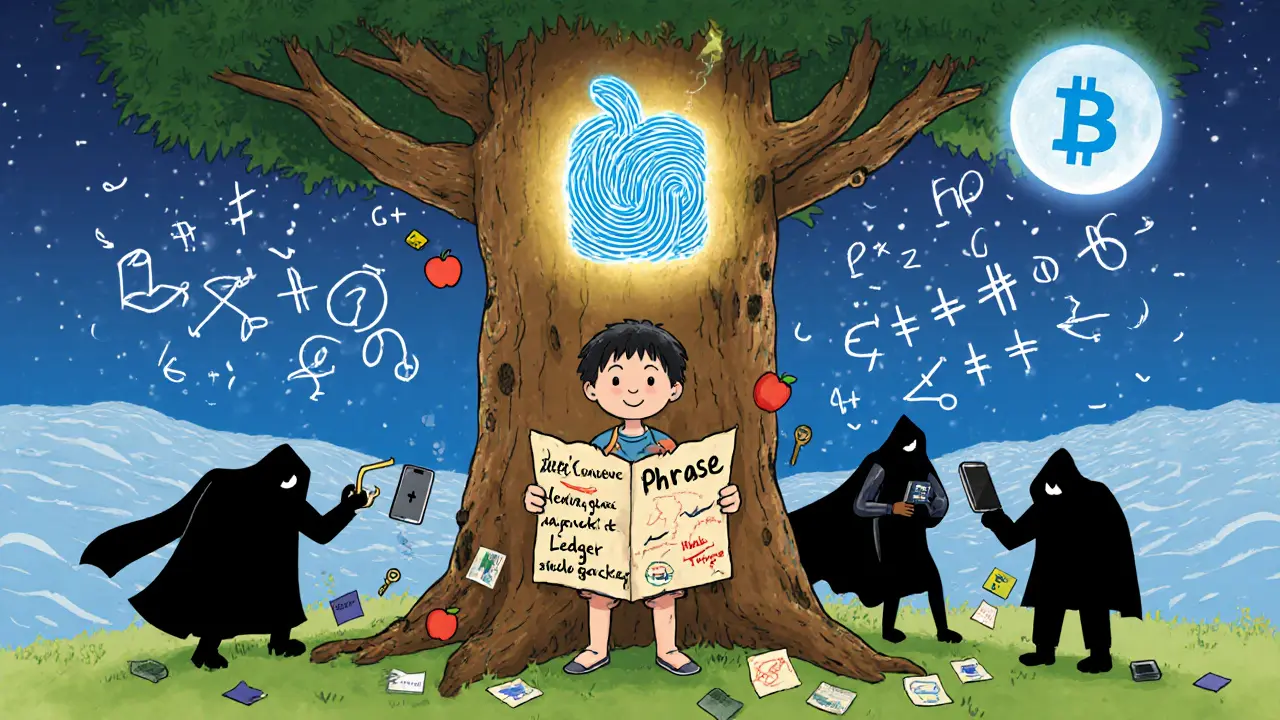

People think blockchain is unhackable. It’s not. It’s just very hard to hack the chain itself. Most breaches happen elsewhere.- Weak key management - 90% of crypto losses come from users losing or leaking private keys. Not because the math broke. Because they emailed their key. Or used a weak password. Or downloaded a fake wallet app.

- Smart contract bugs - Code running on blockchain (like DeFi apps) can have flaws. The encryption is fine, but the logic isn’t. In 2016, the DAO hack stole $60 million because of a coding error, not a broken hash.

- Quantum computing - Future quantum computers could break RSA and ECC encryption, which are used in many blockchains. SHA-256 is more resistant, but not immune. Experts are already working on quantum-resistant algorithms. Ethereum and others are testing them now.

What Developers Use to Build It

If you’re building a blockchain app, you don’t write encryption from scratch. You use trusted libraries:- OpenSSL - Handles hashing and key generation.

- Libsodium - A modern, easy-to-use crypto library for signatures and encryption.

- Ethereum’s Web3.js - Lets you interact with the blockchain and sign transactions in JavaScript.

What’s Next for Blockchain Encryption

The future isn’t just about stronger math. It’s about smarter privacy. Zero-knowledge proofs (ZKPs) are one of the biggest advances. They let you prove you know something-like you have enough funds-without revealing what that something is. Zcash and Ethereum are using this to make transactions private while still being verifiable. That’s encryption doing something new: hiding data without breaking trust. We’re also seeing encryption used beyond finance. Supply chains use it to prove a product’s origin. Governments test it for digital IDs. Hospitals use it to share patient records securely. All of it relies on the same core: hash functions, public keys, and digital signatures.Bottom Line: Encryption Is the Only Thing Keeping Blockchain Alive

Blockchain doesn’t have passwords. It doesn’t have customer support. It doesn’t have a reset button. The only thing standing between your money and a thief is cryptography. And if you don’t understand it, you’re not using blockchain-you’re just gambling with your keys. Learn how your wallet works. Store your private key offline. Don’t trust apps that ask for your seed phrase. Use hardware wallets. Stay updated on quantum-resistant tech. Because in blockchain, your security isn’t someone else’s job. It’s yours.How does cryptographic encryption prevent double-spending in blockchain?

Double-spending happens when someone tries to spend the same digital coin twice. Blockchain stops this by requiring every transaction to be signed with a private key and verified by the network. Each transaction is hashed and added to a block that links to the previous one. If someone tries to create a fake transaction spending the same coins, the network will reject it because the signature won’t match the public key, or because the coins were already spent in an earlier, confirmed block. The cryptographic chain ensures only one version of history is accepted.

Is blockchain encryption the same as regular encryption?

No. Regular encryption, like in your email or bank app, often uses symmetric keys where the same key encrypts and decrypts data. It’s also centralized-your data lives on one server. Blockchain uses asymmetric encryption (public/private keys) and hashing to create a distributed, immutable ledger. The goal isn’t just secrecy-it’s proof of ownership and tamper-proof history. Blockchain encryption doesn’t hide data from everyone; it proves who sent what, and that it hasn’t been changed.

Can blockchain encryption be hacked?

The cryptographic math behind Bitcoin and Ethereum hasn’t been broken. But the system around it can be. Most hacks target weak key storage, phishing, or buggy smart contracts-not the encryption itself. If you leave your private key on a cloud drive, or click a fake link, you’re not getting hacked-you’re giving access away. The encryption is still strong. You just didn’t protect your part of it.

Why is SHA-256 used in Bitcoin?

SHA-256 is used because it’s fast, reliable, and produces a unique 256-bit hash for any input. Even changing one character in a transaction creates a completely different hash. This makes it nearly impossible to reverse-engineer the original data or find two different inputs that produce the same hash. It’s also computationally expensive to brute-force, which helps secure the mining process. Bitcoin’s entire security model depends on SHA-256’s consistency and resistance to collisions.

What happens if I lose my private key?

If you lose your private key, you lose access to your funds forever. There’s no recovery option. No customer service. No password reset. The blockchain doesn’t store your key-it only records transactions tied to your public address. Without the private key, no one-not even the developers-can prove you own those coins. That’s why backing up your seed phrase (a human-readable version of your key) is critical. Write it down. Store it safely. Never digitize it.

Chris Popovec

November 21, 2025 AT 14:09lol so you're telling me my 12-word phrase is literally my life savings? no backups? no customer service? no refund policy? this isn't finance, it's Russian roulette with a crypto wallet and a prayer.

vinay kumar

November 22, 2025 AT 08:42hash functions are just fancy checksums and public keys are just usernames with math attached. people act like this is magic when its just old school crypto repackaged for hype

andrew casey

November 24, 2025 AT 05:44One must recognize that the architectural elegance of asymmetric cryptography, when deployed within a decentralized consensus framework, constitutes not merely a technical innovation but a metaphysical reorientation of trust paradigms. The notion of self-sovereignty, once a philosophical ideal, is now rendered operational through elliptic curve mathematics.

Lani Manalansan

November 25, 2025 AT 18:58I love how this breaks it down without jargon. I showed this to my mom and she finally gets why I won't let her store my seed phrase in Google Docs. Thank you for making crypto feel less like a cult and more like a tool.

Frank Verhelst

November 27, 2025 AT 08:23YES THIS!! 🔥 I just bought my first hardware wallet today. No more cold feet. No more shady apps. Just cold storage and peace of mind. 🛡️

Roshan Varghese

November 29, 2025 AT 04:13sha256 is a government backdoor dont trust it. they already have quantum computers in secret labs and theyre watching your keys. your wallet is already owned. wake up sheeple

Kaitlyn Boone

November 30, 2025 AT 19:06the real vulnerability isnt the math its the people. if you think your phone is secure enough to hold your keys youre already broke. just admit it.

James Edwin

December 1, 2025 AT 01:50every time I read this I feel like I'm learning how to breathe again. blockchain isn't about money-it's about owning your digital identity. this is the foundation of the next century. don't sleep on it.

Kris Young

December 2, 2025 AT 11:14Public key. Private key. Hash. Signature. Transaction. Block. Chain. Confirmation. These are the seven pillars. Master them. Or lose everything.

LaTanya Orr

December 3, 2025 AT 03:06It's funny how we treat encryption like a sacred ritual when really it's just math that works because we all agree to believe in it. We built a religion out of algorithms

Marilyn Manriquez

December 5, 2025 AT 02:19Blockchain encryption is not merely a technological advancement-it is the quiet revolution of individual sovereignty in an age of surveillance capitalism. The implications for human autonomy are profound and enduring.

taliyah trice

December 5, 2025 AT 18:40so if i lose my key its gone forever? yeah that makes sense. i guess i better not forget my password to my password manager

Charan Kumar

December 7, 2025 AT 16:23hash functions are good but why dont we use something faster like blake3? sha256 is old and slow for mobile wallets

Peter Mendola

December 9, 2025 AT 04:0390% of losses? That’s not a system failure. That’s a user failure. And yet, the entire industry still markets this as ‘secure by design.’ It’s not. It’s ‘secure if you’re perfect.’

Terry Watson

December 10, 2025 AT 00:05Wait-so if I sign a transaction, and then I change my mind, I can’t undo it? Even if I got scammed? Even if I made a typo? The system doesn’t care? This is terrifying… and beautiful.

Sunita Garasiya

December 10, 2025 AT 00:23oh so now we're all cryptographers? next you'll tell me we need to memorize the sha256 algorithm before we can buy coffee with bitcoin. chill. the math works. your anxiety doesn't.

Mike Stadelmayer

December 11, 2025 AT 04:42Been holding since 2017. Lost one wallet to a bad backup. Learned the hard way. Now I use a metal plate in a safe. No phone. No cloud. Just me and the steel. Peace of mind? Worth it.

Norm Waldon

December 13, 2025 AT 04:23They say blockchain is decentralized-but who really controls the miners? Who controls the code updates? Who controls the narrative? This is just a new form of elite control disguised as freedom. Don’t be fooled.

neil stevenson

December 14, 2025 AT 07:53bro i just use a password manager and write my seed on a post-it. its fine. why are you all so stressed? 🤷♂️

Samantha bambi

December 15, 2025 AT 15:15Thank you for writing this with such clarity. I shared it with my book club-we’re reading it next week. Finally, someone explained crypto without making it sound like a cult manual.

Anthony Demarco

December 15, 2025 AT 21:47They told us encryption was about privacy but its really about control. The same people who built this are now selling you hardware wallets. Who really benefits? Think deeper.

Lynn S

December 16, 2025 AT 07:25It is deeply concerning that the general populace continues to treat cryptographic key management as an afterthought. This is not a video game. One does not respawn after losing one’s private key. The consequences are absolute, irreversible, and, frankly, unforgivable in a financial context.

Jack Richter

December 16, 2025 AT 20:22meh

sky 168

December 18, 2025 AT 04:31Great breakdown. I just taught this to my niece-12 years old. She asked if the keys are like magic spells. I said yes. And she wants one for her birthday.

Ashley Finlert

December 18, 2025 AT 15:26What fascinates me most isn't the math-it's the cultural shift. We've moved from trusting institutions to trusting abstract mathematics, written by anonymous developers, maintained by strangers across the globe. This isn't just finance. It's a new form of collective belief. We're building a digital cathedral out of algorithms, and we don't even know what we're worshiping anymore. The real revolution isn't in SHA-256-it's in our willingness to let go of human authority and hand our security to code.

And yet, we still write our keys on sticky notes.

Isn't that the most human thing of all? We invent gods to protect us… then forget to lock the temple door.