Crypto Trading Platform: What Works, What Doesn’t, and Where to Avoid Risk

When you pick a crypto trading platform, a digital marketplace where you buy, sell, or trade cryptocurrencies like Bitcoin or Ethereum. Also known as a cryptocurrency exchange, it’s the gateway between your money and the blockchain. But not all of them are worth your time. Some have real security, clear fees, and legal oversight. Others? They vanish after a hype cycle, leave your funds stuck, or never even existed in the first place.

Behind every good crypto trading platform, a digital marketplace where you buy, sell, or trade cryptocurrencies like Bitcoin or Ethereum. Also known as a cryptocurrency exchange, it’s the gateway between your money and the blockchain is a set of real traits: low trading fees, strong security, and regulatory compliance. Take Millionero, a crypto exchange built to follow Europe’s MiCA regulations—it doesn’t promise miracles, but it doesn’t disappear overnight either. Compare that to UZX, a high-leverage exchange with no regulation and zero circulating token supply. One keeps your money safe. The other? It’s a waiting game for your balance to hit zero.

Then there’s the rise of decentralized exchange, a peer-to-peer crypto trading platform that doesn’t hold your funds. Platforms like BabySwap, a niche DEX on Binance Smart Chain for early-stage tokens and SunSwap V3, the leading DEX for TRON-based tokens let you trade without handing over control. That’s powerful—but it also means no customer support if something goes wrong. You’re on your own. And that’s fine if you know what you’re doing. Not so much if you’re new.

Regulation isn’t just a buzzword. In places like Zug, Switzerland’s Crypto Valley with clear DLT laws and banking access, platforms operate openly. In Russia or Ecuador? You can own crypto, but banks block transactions. That shapes what kind of platforms even exist. A platform that works in Europe might be useless in Latin America.

And then there’s the dark side: platforms that never existed. Or ones that did—but now trade at $0 with no team, no updates, and no liquidity. NinjaSwap. OKFLY. SHREW. These aren’t glitches. They’re warnings. If a platform doesn’t show you its audits, its team, or its real trading volume, it’s not a platform—it’s a gamble dressed up as a service.

What you’ll find below isn’t a list of the "best" exchanges. It’s a collection of real stories: who got burned, who stayed safe, and what actually happened when the hype faded. You’ll see how trading fees eat into profits, how regulation keeps some platforms alive while others die, and why a decentralized exchange isn’t always the smart choice—even if it sounds cooler. No fluff. No marketing. Just what’s real, what’s gone, and what still works in 2025.

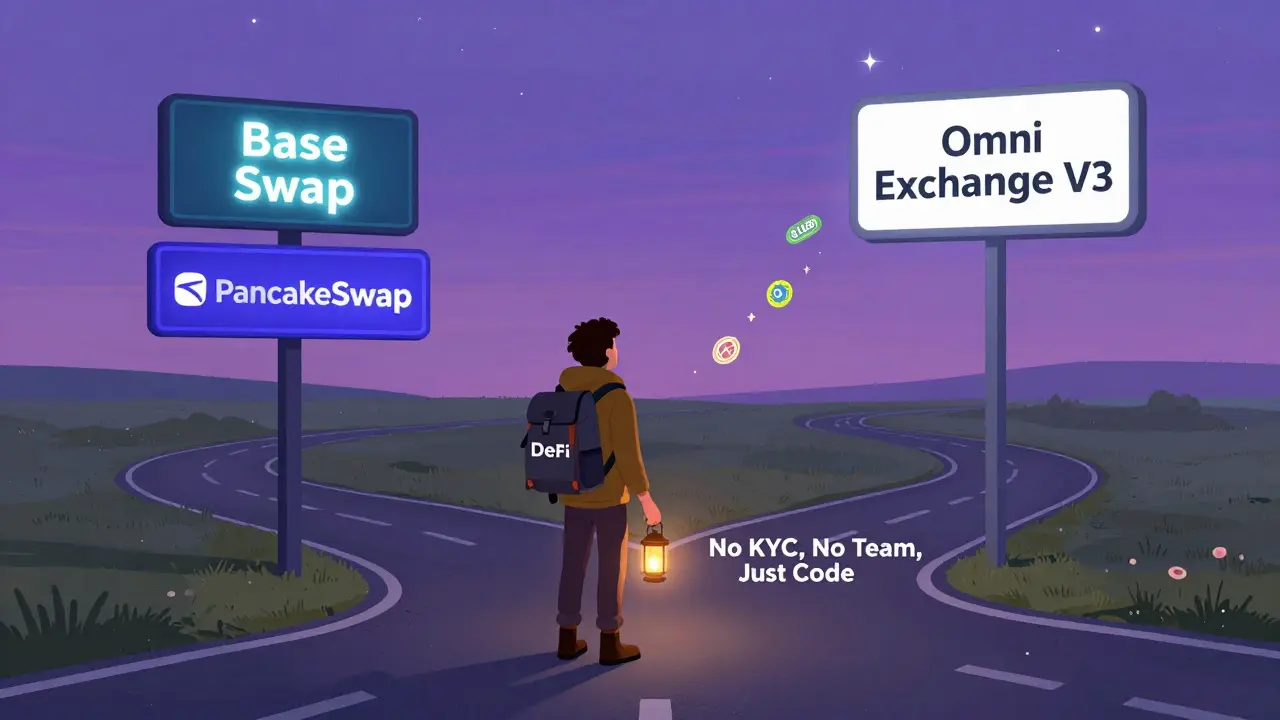

Omni Exchange V3 Crypto Exchange Review: What You Need to Know in 2025

Omni Exchange V3 is a low-fee DEX on Base and BSC with fast swaps and no KYC. But it lacks audits, team info, and support. Best for experienced users trading native tokens, not beginners or security-focused traders.