Bitcoin Mining Profitability Calculator

Mining Profitability Calculator

Hardware Comparison

Recommended ASIC (S21e XP Hyd)

860 TH/s, 11,180W, 12.9 J/TH

- Most home setups with GPUs lose money (RTX 4090: $0.50/day)

- Profitable mining requires electricity < $0.06/kWh

- Network difficulty is rising rapidly (83.15 trillion as of 2024)

- Cooling costs can be 2.5x the miner cost

Profitability Analysis

Daily Profitability

Monthly Projection

Key Factors to Consider

When you hear someone say Bitcoin mining is still profitable, they’re probably not telling you the whole story. The truth? Mining Bitcoin today isn’t like it was in 2017. It’s not about running a rig in your garage and making extra cash. It’s a high-stakes industrial operation where hash rate isn’t just a number-it’s your lifeline.

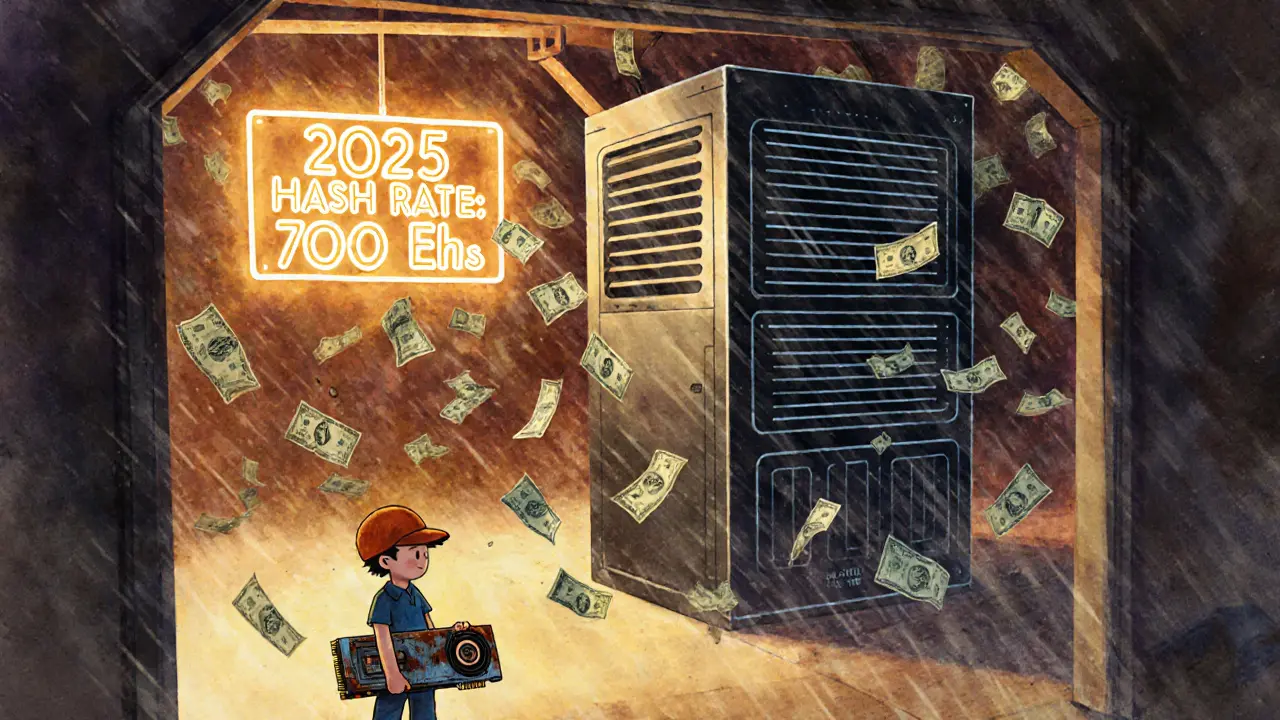

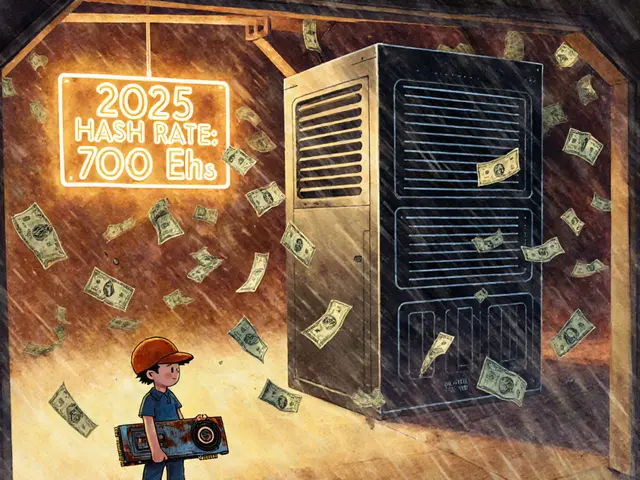

What Hash Rate Actually Means for Your Wallet

Hash rate measures how many calculations your mining rig can perform per second. Think of it like a race: the more hashes you can crunch, the higher your chance of solving the next Bitcoin block and claiming the reward. Today’s Bitcoin network runs at nearly 700 exahashes per second (EH/s). That’s 700 quintillion guesses every second. Your single ASIC miner? It’s competing against thousands of others just like it. The hardware you use makes all the difference. The latest Bitmain AntMiner S21e XP Hyd does 860 terahashes per second (TH/s) and uses 11,180 watts. That’s a lot of power. But here’s the kicker: it’s 100 times more efficient than the GPUs people used five years ago. A top-end NVIDIA RTX 4090? It barely scrapes together 0.000006 BTC per day. The S21e XP Hyd? Around 0.00047 BTC. That’s nearly 80 times more. If you’re using anything but an ASIC for Bitcoin, you’re losing money before you even turn it on.Why the 2024 Halving Changed Everything

On April 20, 2024, Bitcoin’s block reward dropped from 6.25 BTC to 3.125 BTC. That’s a 50% cut in income overnight. The network hash rate didn’t just dip-it crashed 19.3% in the following weeks. Miners with old machines, high electricity bills, or poor cooling shut down. Thousands of them. And that’s exactly what the system was designed to do. When miners leave, the network adjusts difficulty. It gets harder to mine. That’s how Bitcoin keeps blocks coming every 10 minutes, no matter how much computing power is thrown at it. As of October 2024, difficulty hit 83.15 trillion. In January 2020, it was 1.73 trillion. That’s a 4,812% increase in just four years. Your mining rig isn’t just competing with other miners-it’s fighting an ever-tougher puzzle.Electricity Cost: The Real Profit Killer

You can have the best ASIC on the planet, but if your electricity costs $0.15 per kWh, you’re losing money. The average U.S. commercial rate is $0.1178/kWh. That’s already too high for most miners. The break-even point? Around $0.06/kWh. Below $0.05? You’re in the green. That’s why mining operations are moving to places like Texas, where corporate taxes are zero and power is cheap. Or Iceland, where geothermal energy runs at $0.03/kWh. Some miners are even using flared gas from oil fields or hydroelectric surplus from dams. According to Nic Carter of Castle Island Ventures, these renewable-powered operations now control 18.7% of Bitcoin’s total hash rate. They’re making 11.3% more profit than grid-powered miners. That’s not luck-it’s strategy.

ASIC vs GPU vs CPU: The Hard Truth

Let’s say you’re thinking about mining with your gaming PC. Don’t. Here’s what real numbers look like:- AntMiner S21e XP Hyd (ASIC): 860 TH/s, $39.11/day profit (after power), 11,180W

- NVIDIA RTX 4090 (GPU): 0.000006 BTC/day, $0.50/day, 450W

- AMD Threadripper 3990X (CPU): 0.000014 BTC/day, $1.16/day, 280W

Profitability Projections: What the Future Holds

Some calculators say you’ll break even in 18 months. Others say never. Why the difference? Because no one can predict the future perfectly. Jason Blevins’ calculator, used by IEEE Spectrum, assumes difficulty rises 100% per year. That’s aggressive. But it’s not unrealistic. If Bitcoin hits 1.47E+14 difficulty by 2026, your miner needs to be under 10 J/TH to stay profitable. The next wave of ASICs-Bitmain’s S21 Hydro, Canaan’s Avalon 14-are pushing efficiency below 8 J/TH. That’s a 30% improvement over last year’s models. If you bought a miner in 2023, you’re already behind. A miner bought in January 2023 with a $50,000 investment now needs electricity under $0.052/kWh just to break even. That’s not a typo. That’s reality. And here’s the scary part: JPMorgan predicts 68% of today’s mining operations will be unprofitable by 2026 if they don’t upgrade. That’s not a rumor. It’s a financial model based on power costs, difficulty trends, and hardware depreciation.

Hidden Costs Nobody Talks About

You think buying the miner is the big expense? Think again. Cooling costs can be 2.5x the price of the hardware. Noise? AntMiners run at 75-85 decibels-like a vacuum cleaner in your living room. You can’t run them in a bedroom. You need a warehouse, ventilation, and industrial-grade power lines. Then there’s supply. ASIC Miner Value’s Q3 2024 report says average delivery time for new miners is 14.3 weeks. That’s over three months. If you order now, you might not get it until early 2026. By then, the next-gen model could be out. And repairs? They’re expensive. One survey found the average ASIC repair costs $287 per unit. And warranties? Bitmain gives you 180 days. But their support? Average response time is 72 hours. Most miners end up relying on Reddit and BitcoinTalk forums, where community help has an 85% resolution rate.Who’s Still Mining-and Why

The big players now are institutions. Marathon Digital Holdings and Riot Platforms control over 13 EH/s combined. That’s nearly 2% of the entire Bitcoin network. They’re not gambling. They’re betting on long-term value. They have access to cheap power, legal teams, and capital to weather downturns. But they’re not the only ones. Independent miners with access to renewable energy-hydro, wind, stranded gas-are thriving. They’re not just surviving. They’re outperforming grid-powered miners by over 10%. If you’re thinking of joining, you need to ask yourself: Do I have access to power under $0.06/kWh? Do I have space to house and cool hardware? Do I have $5,000+ to spend on equipment I might need to replace in 12-18 months? If the answer is no, you’re not a miner-you’re a speculator.Is Bitcoin Mining Still Worth It in 2025?

Yes-but only for a very specific kind of person. You need to be technical, patient, and financially resilient. You need to treat it like a business, not a hobby. You need to monitor difficulty, power prices, and hardware upgrades like a stock trader. For everyone else? Stick to buying Bitcoin. Mining is no longer a path to quick profits. It’s a high-risk, high-effort industrial venture. The days of mining Bitcoin on a laptop are long gone. The only thing that matters now is efficiency, location, and scale.Those who adapt survive. Those who don’t? They’re already offline.

Is Bitcoin mining still profitable in 2025?

Yes, but only if you have access to electricity below $0.06 per kWh and use a modern ASIC miner like the AntMiner S21e XP Hyd. Most home setups with GPUs or older hardware lose money. Profitability depends almost entirely on power cost, hardware efficiency, and network difficulty.

What’s the best ASIC miner for Bitcoin in 2025?

As of late 2024, the Bitmain AntMiner S21e XP Hyd leads in efficiency at 860 TH/s and 12.9 J/TH. New models like the S21 Hydro and Avalon 14 are coming in 2025 with even better efficiency (under 10 J/TH). Avoid older models like the S19 or T19-they’re too slow and too power-hungry for today’s difficulty levels.

Can I mine Bitcoin with a GPU or CPU?

No, not profitably. Bitcoin uses the SHA-256 algorithm, which is optimized for ASICs. Even the most powerful GPU like the RTX 4090 earns only $0.50 per day after electricity. An ASIC does nearly 80 times more. CPU mining is worse-it’s barely worth the noise. Stick to GPU mining only for coins like Ethereum Classic or Ravencoin.

How does the Bitcoin halving affect mining profits?

Every four years, Bitcoin’s block reward cuts in half. In April 2024, it dropped from 6.25 BTC to 3.125 BTC. This immediately cuts miner revenue by 50%. The network difficulty drops temporarily as weaker miners shut down, then rises again. Only miners with the lowest power costs and newest hardware survive. The 2024 halving forced 32% of marginal miners offline.

What’s the biggest hidden cost of mining?

Electricity. But close behind is cooling and noise. You need industrial-grade ventilation and space to handle the heat and sound of ASICs. Cooling can cost 2.5x the price of the miner. Noise levels (75-85 dB) mean you can’t run them in a home. Delivery delays (up to 14 weeks) and repair costs ($287 per unit) also add up fast.

Where is Bitcoin mining most profitable today?

Regions with cheap, reliable power: Texas (0% corporate tax, low electricity), Iceland (geothermal at $0.03/kWh), and parts of Canada and Kazakhstan. Miners using stranded gas or hydroelectric surplus are 11.3% more profitable than grid-powered ones. Avoid places with high taxes or regulatory bans, like New York or the EU (which added a 20% energy tax in January 2025).

Will Bitcoin mining still be viable in 2030?

Yes-but only for the most efficient operators. As block rewards shrink toward zero after 2140, transaction fees will become the main income. Miners who invest in renewable energy, ultra-efficient hardware, and scale will survive. Those relying on outdated equipment and expensive power won’t. The industry is consolidating: 68% of current operations are projected to be unprofitable by 2026 without upgrades.

rahul saha

November 17, 2025 AT 17:43Marcia Birgen

November 17, 2025 AT 23:15Jerrad Kyle

November 19, 2025 AT 10:31Usama Ahmad

November 20, 2025 AT 11:58garrett goggin

November 22, 2025 AT 01:47Bill Henry

November 23, 2025 AT 02:15Jess Zafarris

November 24, 2025 AT 16:46jesani amit

November 25, 2025 AT 07:08Peter Rossiter

November 26, 2025 AT 08:39Ella Davies

November 26, 2025 AT 17:54Nataly Soares da Mota

November 27, 2025 AT 13:10Teresa Duffy

November 28, 2025 AT 06:14Sean Pollock

November 28, 2025 AT 08:54Student Teacher

November 29, 2025 AT 07:24Mike Calwell

December 1, 2025 AT 05:42Jay Davies

December 2, 2025 AT 04:45Darren Jones

December 2, 2025 AT 08:24Kathleen Bauer

December 4, 2025 AT 06:53Carol Rice

December 5, 2025 AT 03:59Laura Lauwereins

December 5, 2025 AT 05:21Gaurang Kulkarni

December 6, 2025 AT 01:50