Ecuador Crypto Premium Calculator

How Much Extra Do You Pay for Crypto in Ecuador?

In Ecuador, you pay 8-12% above global prices for cryptocurrency due to limited liquidity and informal trading. This calculator shows exactly how much you're paying in your local market.

Your Local Price

Global Market Price:

Local Premium:

Total Cost:

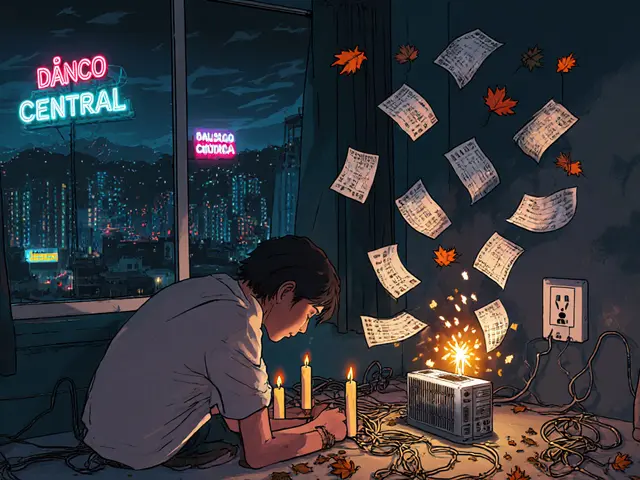

In Ecuador, you can buy Bitcoin. You can hold Ethereum. You can even trade crypto over the counter with cash in Guayaquil. But if you try to send money from your bank account to Binance, it gets blocked. If you use a credit card to buy crypto, the transaction fails. And if you mine with a rig in your garage, you’re fighting 35% import taxes on hardware, rolling blackouts, and electricity bills that cost nearly 15 cents per kilowatt-hour. This isn’t a ban. It’s a cage.

Nothing is legal - but nothing is illegal either

Ecuador doesn’t have a law saying you can’t own crypto. But the Central Bank of Ecuador (BCE) made it clear in August 2024: cryptocurrencies are not legal tender and not authorized as payment. That’s it. No criminal penalties. No fines. Just a wall of silence from the government. You won’t go to jail for buying Bitcoin. But you also won’t get help if you get scammed. This gray zone exists because Ecuador dollarized its economy in 2000. The US dollar is the only official currency. Any alternative - even a digital one - threatens that system. So instead of banning crypto outright, the BCE just refuses to acknowledge it. Banks, payment processors, and insurers are legally required to block any transaction tied to crypto. The Superintendency of Banks keeps a public list of banned exchanges. If you’re using Binance, Kraken, or OKX, you’re already on their radar.How do people actually buy crypto in Ecuador?

If you can’t use your bank, how do you get crypto? The answer is: peer-to-peer (P2P). And it’s messy. Most Ecuadorians who own crypto use platforms like Mercado Bitcoin, LocalBitcoins, or Telegram-based OTC desks. You find someone in your city who wants to sell Bitcoin. You meet in a café. You hand them cash. They send you USDT or BTC. No paperwork. No KYC. Just trust - and risk. That’s why premiums are high. On average, crypto in Ecuador sells for 8-12% above global prices. Why? Because liquidity is low. There’s no exchange. No market maker. No competition. Sellers know you have no other option. A 2024 OWNR Wallet survey found that 68% of crypto users in Ecuador receive funds from family abroad - usually in stablecoins - and then convert them to cash through these informal channels. And it’s dangerous. One in four Ecuadorian crypto users reported being targeted by fraud. Fake sellers. Fake buyers. Scams disguised as OTC deals. The Reddit community r/CryptoEcuador has over 1,200 members, and half the posts are about frozen accounts, stolen funds, or bank warnings.Why is banking so strict?

Ecuador’s banking system is built around the US dollar. The BCE doesn’t want competition. It doesn’t want volatility. And it doesn’t want capital flight. In Q4 2023, Ecuador saw $1.2 billion in unexplained money leaving the country. The BCE blames crypto. Critics say it’s just a convenient excuse. The real issue? Only half of Ecuador’s adult population has a bank account. That’s 5 million people cut off from formal finance. Many of them send or receive remittances - $3.8 billion a year - with fees as high as 6.3%. In Mexico or Colombia, people use crypto to cut those fees to under 2%. In Ecuador? They can’t. Banks aren’t just being cautious. They’re forced to. The Monetary and Financial Policy and Regulation Board (JPRM) issued resolutions in 2022 and 2023 that explicitly ban crypto as a payment method. The Superintendency of Banks enforces it. If a bank processes a crypto transaction, it risks losing its license. So they block everything - even transfers to wallets you own.

What about mining?

Mining isn’t illegal. But it’s practically impossible. Electricity costs $0.145 per kWh - 23% higher than the Latin American average. Power outages happen 14.7 hours a month on average. And if you want to buy a mining rig? You pay 35% in import duties on top of the price. Most miners are hobbyists with one or two ASICs tucked away in Quito or coastal towns. The entire country’s hash rate? Less than 0.0001% of the global total. That’s not a threat. It’s a footnote. No mining pools operate in Ecuador. No industrial farms. No crypto-friendly data centers. Just a few people trying to make a few dollars a month while their lights flicker.Taxes - yes, you have to pay them

Even though the government won’t recognize crypto as money, it still wants a cut. The Internal Revenue Service (SRI) treats crypto gains as taxable income. If you sell Bitcoin for USD and make a profit, you owe tax. Individuals pay up to 35%. Companies pay 25%. But here’s the catch: no one tracks it. The SRI doesn’t have access to blockchain data. There’s no reporting requirement. No Form 1099. No IRS-style audits. So most people don’t report. But the law is there. If you’re caught, you’re on the hook.How does Ecuador compare to its neighbors?

Ecuador is an outlier in Latin America. - Peru requires all crypto exchanges to register with the Financial Intelligence Unit (UIF) as of June 2025.- Mexico has had a fintech law since 2018 that licenses crypto service providers.

- Paraguay allows crypto payments and mining under a 2022 law with AML rules.

Ecuador? Nothing. No licensing. No registration. No legal framework. Just warnings and blocks. The UN’s ECLAC called this approach “contradictory.” With half the population unbanked, and remittance costs so high, crypto could be a lifeline. Instead, the government pushes it underground.

What’s next for crypto in Ecuador?

There are signs things might change - slowly. In early 2025, new rules will require fintech startups to incorporate as sociedades anónimas, carry $200,000 in capital, and get special registration to offer tech-based financial services. That’s not crypto-specific, but it’s a step toward formalizing digital finance. The BCE is also testing a Central Bank Digital Currency (CBDC) - a digital version of the US dollar. If it launches, it could create infrastructure that eventually supports regulated crypto services. But the BCE says the CBDC is about “modernizing small payments,” not enabling Bitcoin. Analysts are split. Some predict regulation by 2026. Others say the BCE will hold firm until 2027 or beyond. The fear? Capital flight. The reality? People are already moving money - just without oversight.What should you do if you’re in Ecuador?

If you want to use crypto here, here’s what works:- Use P2P platforms like Mercado Bitcoin or Telegram OTC desks.

- Pay in cash. Never link your bank account.

- Only deal with people recommended by local communities. Check Reddit and Telegram groups.

- Keep records of your trades. You might need them for taxes.

- Don’t trust any exchange that claims to be “licensed in Ecuador.” There are none.

- Use hardware wallets. Never leave crypto on an exchange.

Why does this matter?

Ecuador’s crypto restrictions aren’t just about money. They’re about control. The government chose dollarization to stabilize the economy. But in doing so, it locked out innovation. People who need financial tools - the unbanked, the remittance-receiving families, the small business owners - are left with risky, expensive, and illegal workarounds. The result? A $135 million crypto market in a country of 18 million people. Compare that to Colombia’s $1.2 billion or Mexico’s $8.9 billion. Ecuador’s economy is growing. Its people are tech-savvy. But the rules are stuck in 2000. Until the BCE decides that financial inclusion matters more than control, crypto in Ecuador will stay in the shadows - useful, dangerous, and always one step ahead of the law.Is it legal to buy Bitcoin in Ecuador?

Yes, buying, holding, and trading Bitcoin is legal in Ecuador. The Central Bank of Ecuador does not ban private cryptocurrency transactions. However, Bitcoin is not legal tender, and banks are required to block any direct transfers to exchanges. Most people buy crypto through peer-to-peer cash deals.

Can I use crypto to pay for goods or services in Ecuador?

No. The Central Bank of Ecuador and the Monetary and Financial Policy and Regulation Board (JPRM) explicitly prohibit cryptocurrencies as a means of payment. No business can legally accept Bitcoin or Ethereum as payment for goods or services. Doing so could trigger bank account freezes or regulatory scrutiny.

Do I have to pay taxes on crypto gains in Ecuador?

Yes. The Internal Revenue Service (SRI) treats profits from selling cryptocurrency as taxable income. Individuals pay up to 35% on gains, and companies pay 25%. While there’s no official reporting system, the law is enforceable. Keeping records of trades is strongly advised.

Why can’t I send money from my Ecuadorian bank to Binance?

Banks in Ecuador are legally required to block cryptocurrency-related transactions under resolutions from the Monetary and Financial Policy and Regulation Board (JPRM) and directives from the Superintendency of Banks. Any transaction flagged as crypto-related - even to your own wallet - will be rejected or lead to account freezes.

Is crypto mining allowed in Ecuador?

Mining is not explicitly banned, but it’s extremely difficult. High electricity costs ($0.145/kWh), frequent power outages (14.7 hours/month), and 35% import duties on mining hardware make large-scale operations unfeasible. Most mining is done by individuals with small rigs, and the total national hash rate is negligible.

Are there any licensed crypto exchanges in Ecuador?

No. There are no licensed cryptocurrency exchanges operating within Ecuador’s formal financial system. All major platforms like Binance, Kraken, and OKX are on the Superintendency of Banks’ list of unauthorized entities. Local users rely on offshore P2P platforms or Telegram-based OTC desks.

What’s the future of crypto in Ecuador?

The future is uncertain. The Central Bank is developing a dollar-pegged Central Bank Digital Currency (CBDC), which could create infrastructure for future digital finance. Fintech startups are pushing for regulation, and pressure is growing from remittance users. But the BCE remains resistant. Without policy change, crypto activity will remain informal, risky, and limited.

Mauricio Picirillo

November 15, 2025 AT 13:17Man, this is wild. I grew up in Ecuador and remember when dollarization happened. Now seeing crypto become this underground lifeline for people who just want to send money home or buy stuff without getting ripped off? It’s not rebellion-it’s survival. The banks aren’t protecting us; they’re just keeping the system frozen in 2000.

And yeah, the 12% premium? That’s the tax you pay for having zero options. If you think that’s bad, try getting a wire sent from the US without paying 8% in fees. At least with crypto, you’re not dealing with some middleman who doesn’t even speak Spanish.

Also-huge props to the folks mining in their garages. I know a guy in Cuenca with two Antminers and a fan he jury-rigged from a ceiling fan. He makes $15/month. But he’s not complaining. He’s just glad he’s not stuck with the bank’s 5% monthly fee just to hold his own money.

Liz Watson

November 15, 2025 AT 22:18Oh wow. A whole article about how Ecuadorians are ‘struggling’ with crypto… while the rest of the world is moving on to DeFi, tokenized real estate, and AI-driven wallets. You people are still trading BTC for cash in Starbucks like it’s 2014. Can we please stop romanticizing this? It’s not ‘resistance,’ it’s technological poverty.

And don’t even get me started on ‘mining’ with a single ASIC while the lights flicker. That’s not a hobby-it’s a cry for help. Next you’ll tell me the ‘crypto community’ is ‘building something beautiful.’ It’s just a glorified black market with better UX.

Rachel Anderson

November 16, 2025 AT 10:01My heart is literally breaking. 💔

Imagine being in Ecuador and wanting to buy Bitcoin… but your bank blocks you. Your electricity cuts out every other day. You pay $0.15 per kWh just to run a fan… and then you’re expected to mine? With a 35% import tax on your ASIC? It’s like asking someone to build a rocket ship out of duct tape and hope it gets to the moon.

And the worst part? The government just… looks away. Like a parent pretending not to see their kid crying in the corner. No help. No guidance. No mercy. Just silence. And yet, people still do it. Because hope isn’t a policy. It’s a human instinct.

I’m crying. I’m crying so hard right now.

Hamish Britton

November 17, 2025 AT 09:55Interesting how this mirrors what happened in Argentina and Venezuela-but without the hyperinflation. Ecuador’s dollarization was supposed to bring stability. But it ended up creating a financial monoculture. No room for innovation. No safety valve for the unbanked.

What’s missing here isn’t just regulation-it’s infrastructure. If the BCE wanted to be helpful, they’d partner with P2P platforms to create KYC-lite channels for remittances. Not block them. Not ignore them. Engage.

Also, the tax thing is wild. You’re taxing gains but not tracking them? That’s like charging tolls on a road you refuse to pave. It’s not enforcement-it’s extortion by bureaucracy.

Katherine Wagner

November 17, 2025 AT 20:32ratheesh chandran

November 18, 2025 AT 11:16you know… the real tragedy is not the bank blocks or the power outages… it’s the silence of the soul… when you hold bitcoin in your wallet… and no one in your family understands… they think you’re wasting money… but you know… you’re holding the future… the future that doesn’t need permission… the future that doesn’t ask… it just is…

and yet… you still feel alone… even in a crowd… because they don’t see the blockchain… they only see the numbers… and numbers… are just numbers… until they’re your freedom…

Hannah Kleyn

November 20, 2025 AT 04:35I’ve been following this for a while and honestly the most fascinating part is how people just… adapt. Like they don’t wait for permission. They don’t petition. They don’t protest. They just find a way. Meet in cafés. Trade cash. Use Telegram. No forms. No IDs. Just vibes and trust.

And the fact that 68% of users get crypto from family abroad? That’s not a loophole-that’s a lifeline. Remittances are the backbone of so many households. If you took away crypto, you’d be taking away breakfast, school supplies, medicine.

Also, the tax thing? Yeah, you’re supposed to report it. But who’s gonna audit someone who bought $500 worth of USDT from a guy named Carlos at a gas station? The SRI doesn’t even have the bandwidth. So it’s not tax evasion-it’s practical non-enforcement.

And mining? One guy I talked to said his rig runs on solar now. He bought panels from a guy on Reddit. It’s not a data center. It’s a DIY rebellion. And honestly? Kinda beautiful.

gary buena

November 21, 2025 AT 09:36Wait wait wait-so you can’t send money to Binance but you can buy crypto with cash? That’s like saying you can’t use a credit card to buy beer but you can buy it from a guy in a hoodie behind the gas station.

Also, the 35% import tax on mining gear? That’s like taxing oxygen. You’re not stopping mining-you’re just making it harder for people who actually care about it. Meanwhile, the government’s CBDC? Probably gonna be just as useless as their digital ID system. Two years in and still can’t log in.

And I love how no one’s talking about how the unbanked are using crypto to bypass the 6.3% remittance fees. That’s real financial inclusion. Not some government app that freezes your account for ‘suspicious activity’ because you sent $200 to your cousin.

Vanshika Bahiya

November 21, 2025 AT 11:38Hey everyone-just wanted to add a practical tip if you’re in Ecuador and using P2P: always meet in a public place with security cameras. Not just a café-preferably a bank lobby or a big supermarket. And always check the seller’s history on Mercado Bitcoin. Look for at least 10 completed trades with 5-star ratings.

Also, use a hardware wallet like a Ledger. Don’t leave crypto on any phone app. I’ve seen too many people get scammed because they trusted a ‘friend’ who sent them USDT and then ghosted them.

And yes, taxes are real. Keep screenshots of every trade. Even if you don’t report now, someday the SRI might start auditing. Better safe than sorry. You don’t want to owe $10k in back taxes because you didn’t save a receipt.

And to the guy mining in his garage? You’re a legend. Please share your setup. I want to try it too.

Albert Melkonian

November 22, 2025 AT 20:27While the current regulatory environment in Ecuador is undeniably restrictive, it is imperative to recognize that the foundational principles of financial sovereignty and individual autonomy remain intact. The absence of explicit prohibition does not equate to indifference-it reflects a deliberate policy of non-interference, which, while seemingly paradoxical, permits grassroots innovation to flourish in the absence of institutional endorsement.

Furthermore, the emergence of peer-to-peer networks as a de facto financial infrastructure is not a failure of governance but rather a testament to the resilience of human ingenuity. When formal systems fail to meet the needs of the populace, informal systems inevitably arise. This is not an anomaly; it is a predictable outcome of economic exclusion.

One might argue that the Central Bank’s stance is shortsighted, yet one must also acknowledge that institutional inertia is often a function of systemic complexity, not malice. The path forward, therefore, lies not in confrontation, but in constructive engagement-through pilot programs, stakeholder dialogue, and evidence-based policy development. The future of finance is not centralized. It is decentralized. And Ecuador, despite its constraints, is already living it.

Kelly McSwiggan

November 24, 2025 AT 15:32Let’s be real: Ecuador’s crypto scene is a dumpster fire wrapped in a ‘resilient community’ narrative. You’ve got people risking their lives for 8% premiums because the government refuses to modernize. Meanwhile, the rest of Latin America is building regulated exchanges and tokenized bonds.

And mining? Please. You’re not a crypto pioneer-you’re a guy with a noisy rig and a $200 electricity bill. The hash rate is statistically irrelevant. This isn’t decentralization. It’s desperation with a Bitcoin logo.

The SRI taxing gains without tracking them? That’s not policy. That’s bureaucratic laziness. You’re not enforcing tax law-you’re just hoping people forget they owe money.

And the CBDC? Yeah, that’s just the government trying to rebrand surveillance as ‘progress.’

Bottom line: Ecuador isn’t a crypto frontier. It’s a cautionary tale.

Byron Kelleher

November 26, 2025 AT 10:52Honestly? I’m just impressed by how people are making this work. No bank? No problem. No legal framework? Still going. I mean, imagine being in a country where you can’t even wire money to your own wallet-but you still find a way to get crypto. That’s not illegal. That’s human.

And yeah, the premiums are high. The power cuts are annoying. The taxes are sketchy. But people are still doing it. Not because they want to break rules. Because they need to live.

I hope the BCE wakes up soon. Not because they’re scared of crypto. But because they’re scared of their own people. And that’s the saddest part.

Keep going, Ecuador. You’re doing better than the system thinks you are.

Cherbey Gift

November 28, 2025 AT 09:36yo… this whole thing is like a spiritual war… the banks are the priests of the old god… dollarization… they chant ‘stability’… but what stability? When your grandma can’t send money to her grandkid because the bank says ‘crypto suspicious’? That’s not stability… that’s spiritual death.

crypto in ecuador? it’s not money… it’s prayer… it’s the whisper in the dark… when the lights go out… and the only thing glowing is your phone… with a balance… and a private key… and a dream…

they can block transactions… but they can’t block hope…

and when the CBDC comes? it’ll be just another chain… locked… controlled… monitored…

but the real blockchain? it’s in the hearts of the people who meet in cafés with cash… and smile… because they just gave each other freedom…

Anthony Forsythe

November 28, 2025 AT 13:33There is a metaphysical truth here, one that transcends mere economics: the dollar, once a symbol of liberation from hyperinflation, has become the chains of a new colonialism-not of territory, but of thought. Ecuador, by embracing the dollar, surrendered not just its currency, but its monetary imagination.

Cryptocurrency, in this context, is not a tool. It is a reclamation. A silent, decentralized act of ontological rebellion. To mine with a single ASIC under flickering fluorescent lights is to assert: ‘I am still here. I still have agency.’

The BCE fears not Bitcoin. They fear the idea that value can exist outside their gaze. That trust can be algorithmic. That money need not be sanctified by a central authority.

And so they build walls. But walls do not stop rivers. They only redirect them. And the river of crypto in Ecuador? It flows through cafés, through Telegram, through the quiet determination of a mother sending remittances to her daughter in Miami-without fees, without permission, without apology.

This is not a crisis. It is a revelation.

Kandice Dondona

November 28, 2025 AT 16:59YESSSS this is so real 😭❤️

I have a cousin in Guayaquil who buys crypto with cash every week. She says it’s the only way she can save money without the bank taking 10% in ‘service fees’ just to hold it. She uses a Ledger. She never tells anyone. But she told me. And I cried.

Also, the mining guy in Quito? He’s my hero. He runs his rig on solar panels he built from scrap. He calls it ‘the little Bitcoin garden.’ 🌱💸

And yes, taxes are a thing. But honestly? If you’re not rich enough to get audited, you’re not rich enough to care. 😅

Love y’all. Keep going. The future is P2P. And it’s beautiful. 💫

Mauricio Picirillo

November 29, 2025 AT 18:58Just saw Kandice’s comment about the ‘Bitcoin garden’-that’s the most beautiful thing I’ve read all week. I’ve been thinking about that guy in Quito too. He posted a photo last month: his rig next to a potted cactus. Caption: ‘One grows in soil. The other grows in code.’

That’s Ecuador. The same people who can’t get a loan from the bank are building their own financial ecosystem-with cash, code, and cacti.

Vanshika Bahiya

December 1, 2025 AT 18:43And to Hamish’s point earlier-about engagement over blocking-exactly! The BCE could’ve partnered with Mercado Bitcoin to create a KYC-verified P2P gateway. Instead, they blocked everything. Now people use Telegram bots with no identity checks. That’s way riskier.

Imagine if they just required a simple ID scan for OTC trades-like how Kenya did with M-Pesa. Safe. Simple. Legal.

Instead, they’re waiting for someone to get scammed… then blame crypto.