Zug Crypto Regulations: What You Need to Know About Switzerland’s Crypto-Friendly Hub

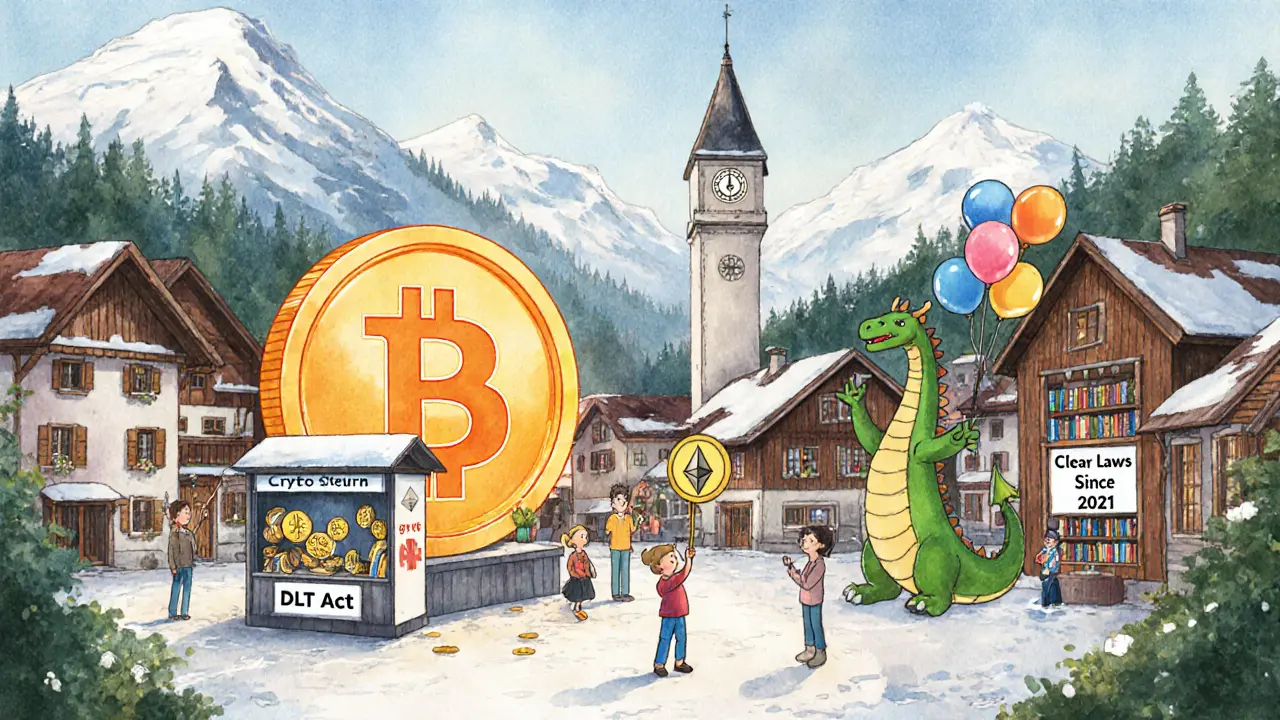

When it comes to Zug crypto regulations, the clear, business-friendly legal framework for blockchain and digital assets in the Swiss city of Zug. Also known as Crypto Valley, it’s where startups, exchanges, and investors go to build without guessing what the law will do next. Unlike places that ban crypto or bury it in red tape, Zug made rules simple: if you’re building a blockchain project, you can register, pay taxes, and operate without fear of sudden crackdowns.

This isn’t just about being nice to crypto. Zug’s government works directly with blockchain firms to shape laws that actually fit the tech. For example, token sales don’t automatically count as securities — they’re treated as utility tokens unless proven otherwise. That’s a huge difference from the U.S. or EU, where regulators often assume the worst. The Switzerland cryptocurrency laws, a national framework that supports innovation while enforcing anti-money laundering rules. Also known as FINMA guidelines, it gives companies legal clarity across the whole country, not just Zug. And because Switzerland doesn’t have a federal crypto ban, local cities like Zug can move faster. They’ve created special zones where crypto businesses can test new models without jumping through 100 hoops.

Want to set up a crypto company? You’ll need to register with the local commercial registry, but you won’t need a special permit. Crypto mining? Legal. Holding Bitcoin? No capital gains tax if you’re an individual. Trading on exchanges? Taxable, but only if you convert to fiat. The crypto-friendly jurisdiction, a place where legal systems actively support blockchain adoption without overregulation. Also known as Crypto Valley, it’s why companies like Cardano, Polkadot, and Ethereum Foundation have offices here. Even banks in Zug are crypto-aware — some even offer custody services. You won’t find this kind of openness in most countries.

But Zug isn’t a free-for-all. Anti-money laundering rules are strict. You must verify users, report suspicious activity, and keep records. The government doesn’t want criminals using its reputation. That’s why it works with the blockchain regulation, the official policies and oversight systems governing digital asset use in a specific region. Also known as FINMA oversight, it’s designed to balance innovation with safety. If you follow the rules, you get support. If you don’t, you get shut down — fast.

What you’ll find in the posts below are real examples of how these rules play out: from how a Swiss crypto startup handles taxes, to why a token project chose Zug over Dubai, to what happens when a blockchain firm gets audited. No fluff. No hype. Just what works — and what doesn’t — in one of the most transparent crypto environments on Earth.

Switzerland Crypto Valley Regulations in Zug: What You Need to Know in 2025

Zug, Switzerland, is the world's most advanced crypto regulatory hub. Learn how its clear tax rules, DLT Act, and banking access make it the safest place to build and hold crypto in 2025.