Crypto Valley laws: The real rules behind the world’s crypto hubs

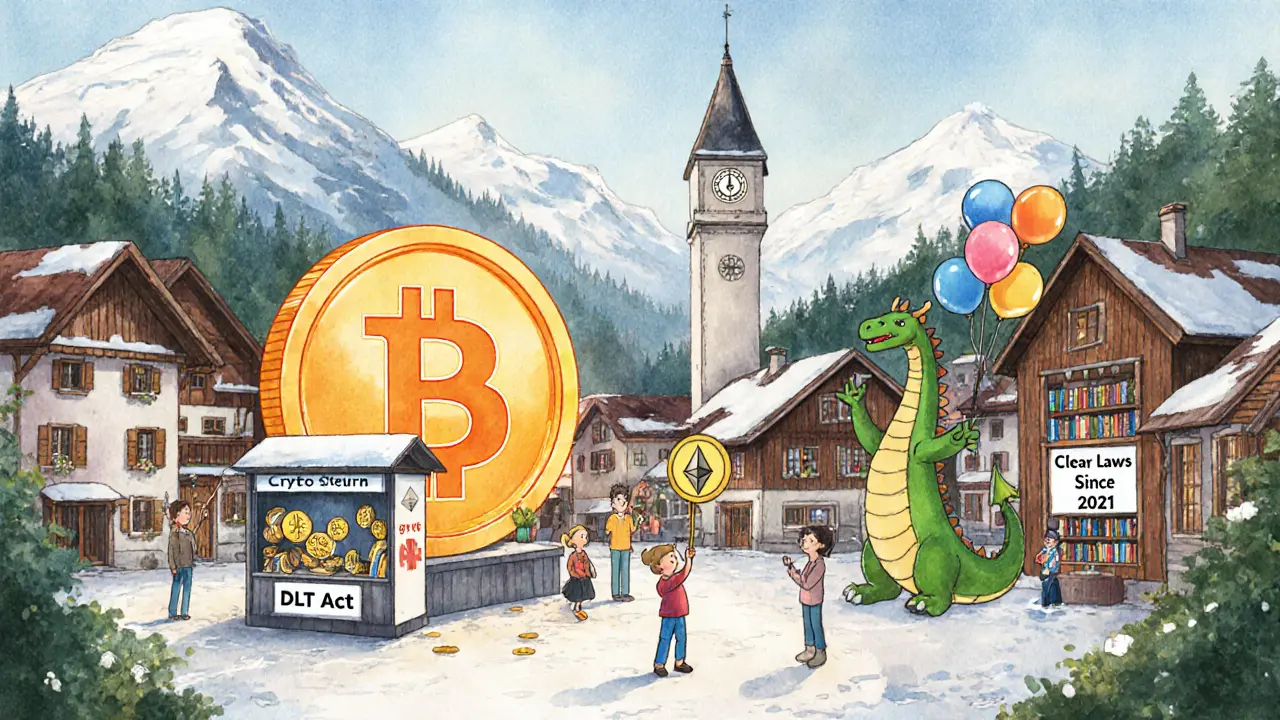

When people talk about Crypto Valley, a term for the dense cluster of blockchain companies and regulators centered in Switzerland and Liechtenstein. It’s not just a nickname — it’s a legal ecosystem that’s shaped how the entire crypto world operates. Unlike places that ban crypto or treat it like a gray area, Crypto Valley built clear rules for tokens, exchanges, and smart contracts. That’s why companies like Chainlink, Tezos, and hundreds of others set up shop there — not because of the mountains, but because of the laws.

These Switzerland crypto regulations, a balanced, business-friendly legal approach that treats crypto assets as property, not currency let startups issue tokens without needing a full banking license. Liechtenstein blockchain laws, the world’s first comprehensive blockchain legislation, passed in 2020 went even further — they defined tokens as legal assets you can own, transfer, and inherit, just like stocks or real estate. That’s huge. It means if you hold a token, the law recognizes your right to it — even if the company behind it vanishes.

But Crypto Valley isn’t just about being friendly. It’s also about control. The Swiss Financial Market Supervisory Authority (FINMA) doesn’t just say "go ahead." They classify tokens as payment, utility, or asset tokens — and each type has different rules. If you’re raising money with a token, you better know which category you’re in. Miss it, and you’re in trouble. That’s why so many projects publish legal whitepapers alongside their tech ones.

These laws don’t just affect companies in Zurich or Vaduz. They set the global standard. When the EU drafts new crypto rules, they look at Crypto Valley. When the U.S. struggles with whether a token is a security, regulators check what Switzerland did. Even countries like Ecuador and Myanmar, where crypto is blocked or restricted, are watching how Crypto Valley handles compliance, taxes, and user protection.

What you’ll find in the posts below isn’t just a list of news stories. It’s a real look at how crypto laws play out in practice — from how a token gets classified, to how banks react, to why some projects vanish under regulatory pressure. You’ll see how Crypto Valley laws created a safe space for innovation, and why other regions struggle to copy it. Whether you’re holding a token, running a DeFi app, or just trying to understand why some places are crypto-friendly and others aren’t — this collection gives you the context you need to make sense of it all.

Switzerland Crypto Valley Regulations in Zug: What You Need to Know in 2025

Zug, Switzerland, is the world's most advanced crypto regulatory hub. Learn how its clear tax rules, DLT Act, and banking access make it the safest place to build and hold crypto in 2025.