Bitcoin mining

When talking about Bitcoin mining, you’re looking at the process that creates new BTC and secures the network. Bitcoin mining, the computational work that validates transactions and adds blocks to the blockchain. Also known as crypto mining, it fuels the entire Bitcoin ecosystem.

Crypto mining, the broader practice of using hardware to solve cryptographic puzzles for various digital assets isn’t just about Bitcoin. It includes Ethereum, Litecoin, and dozens of smaller coins, each with its own algorithm and reward structure. Understanding crypto mining helps you compare profitability across assets and decide where to allocate your rigs.

Energy costs, the price you pay for electricity to run mining hardware are the single biggest expense for any miner. In regions where power is cheap, like certain parts of Kazakhstan or the Pacific Northwest, miners can squeeze out higher margins. Conversely, high tariffs can turn a once‑profitable operation into a loss-maker overnight.

Mining‑friendly jurisdictions, countries that offer low energy prices, clear regulations, and tax incentives for miners shape where the industry clusters. Our 2025 ranking highlights spots such as Canada’s Alberta province, Georgia, and Iceland, each balancing climate, policy, and cost. Picking the right jurisdiction can shave years off your break‑even point.

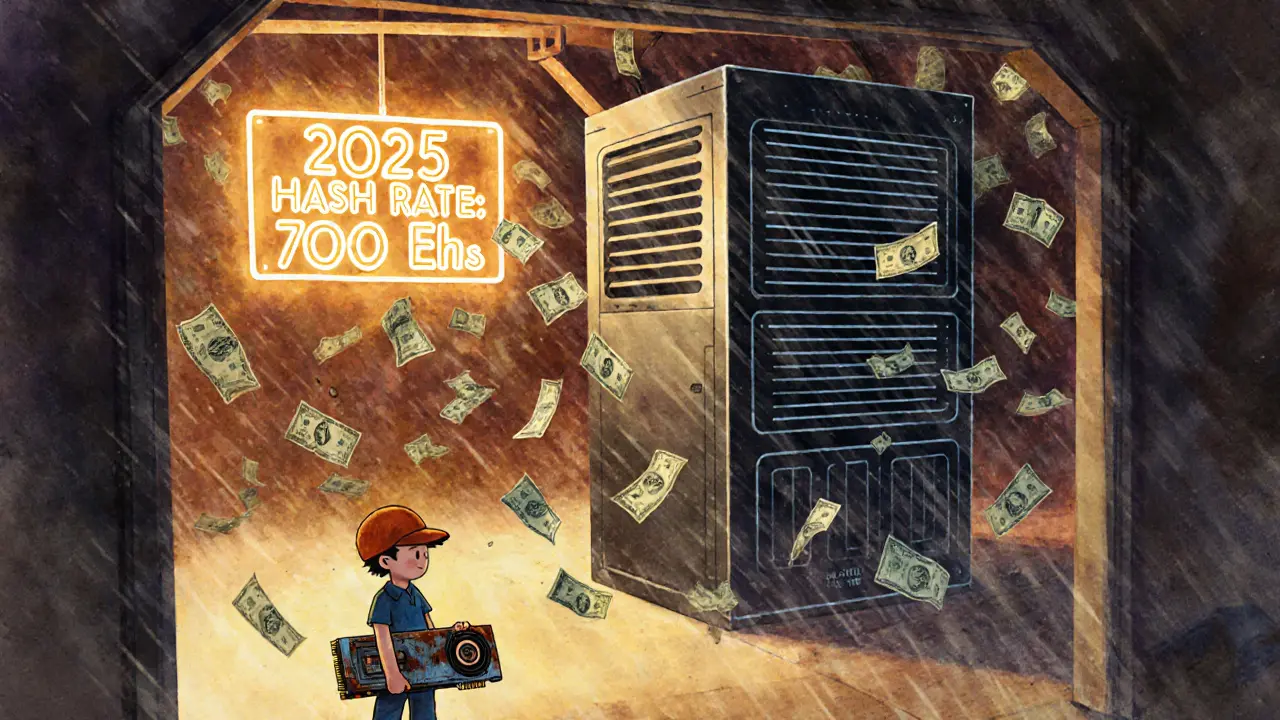

Hash rate, the total computational power of a mining setup, measured in hashes per second directly influences how often you find a block. Modern ASICs push the hash rate into terahashes, but they also draw more power. Finding the sweet spot between hardware efficiency and electricity price is the hallmark of a skilled miner.

Key factors that influence Bitcoin mining profitability

Tax regimes add another layer of complexity. Some nations tax mining rewards as ordinary income, while others treat them like capital gains or even exempt them entirely. Knowing the local tax code can prevent surprise bills and improve net returns.

Environmental impact is no longer a footnote. Communities increasingly demand greener operations, pushing miners toward renewable sources or carbon‑offset programs. Aligning with sustainability standards can also open doors to financing and partnership opportunities.

Finally, strategic choices—like joining a mining pool, optimizing firmware, or timing equipment upgrades—can boost earnings without extra capital. By keeping an eye on market difficulty, BTC price trends, and hardware lifecycles, you can adapt your operation to stay ahead of the curve.

Below you’ll find a curated collection of articles that dive deeper into each of these topics, from country rankings to tax guides and hardware reviews. Use them to fine‑tune your own mining plan and stay informed about the fast‑moving landscape of Bitcoin mining.

Hash Rate and Mining Profitability: How Much You Really Earn Mining Bitcoin in 2025

Bitcoin mining profitability in 2025 depends on hash rate, electricity costs, and hardware efficiency. ASIC miners dominate, but only those with cheap power and modern equipment still make money.

Proof of Work Explained: How Blockchain Consensus Works

Learn what Proof of Work is, how it secures blockchain, its energy impact, and how it compares to Proof of Stake in a clear, practical guide.