Base Chain Exchange: Where to Trade on Base Network in 2025

When you trade on a Base chain exchange, a cryptocurrency trading platform built specifically for the Base blockchain, a low-cost, Ethereum-linked network backed by Coinbase. Also known as Base network exchange, it lets you swap tokens with fees under a penny and near-instant confirmations—perfect for everyday traders who hate gas wars on Ethereum. Unlike older chains that charge $5 to $20 per trade, Base keeps costs low so even small trades make sense. This matters because most crypto activity today isn’t about big investors—it’s about people buying meme coins, staking new tokens, or swapping stablecoins like USDbC without getting ripped off by fees.

Base chain exchanges are different from general crypto platforms like Binance or Coinbase. They’re built to work natively with Base’s infrastructure, meaning they support Base-native tokens, integrate with Base wallets like Coinbase Wallet, and often have lower slippage on trades. You’ll find both centralized options that let you deposit USD and decentralized exchanges (DEXs) that run entirely on-chain with no KYC. Many of the top ones are built by teams who understand that speed and cost matter more than flashy interfaces. If you’re trading tokens like PAD, TURBO, or even new airdrops tied to Base, you need a platform that actually supports the chain—not one that just lists it as an afterthought.

Related entities like decentralized exchange, a peer-to-peer trading platform that runs without a central company, using smart contracts instead. Also known as DEX, it’s the backbone of Base’s ecosystem and Base network, a Layer 2 blockchain built on Ethereum that uses OP Stack technology to offer fast, cheap transactions. Also known as Base blockchain, it’s the foundation for all these exchanges shape how these platforms behave. You won’t find high-leverage futures or complex derivatives on most Base exchanges—those are for bigger chains. Instead, you’ll see simple swaps, liquidity pools, and token launches. The focus is on usability, not complexity. That’s why you’ll see posts here about exchanges like BabySwap on BSC, but not on Base—because Base has its own set of players, and they’re not the same.

What you’ll find in this collection are real reviews of exchanges that actually work on Base in 2025. Not hype. Not speculation. Just facts: who has real volume, who’s been audited, who charges hidden fees, and who’s just a dead app with a fancy logo. Some are full-service platforms with fiat on-ramps. Others are pure DEXs you can use with just a wallet. You’ll also see warnings about fake exchanges pretending to be on Base—because scams love low-fee chains. If you’re trading on Base, you need to know which platforms are worth your time. This page gives you the context to pick the right one—and avoid the ones that vanish tomorrow.

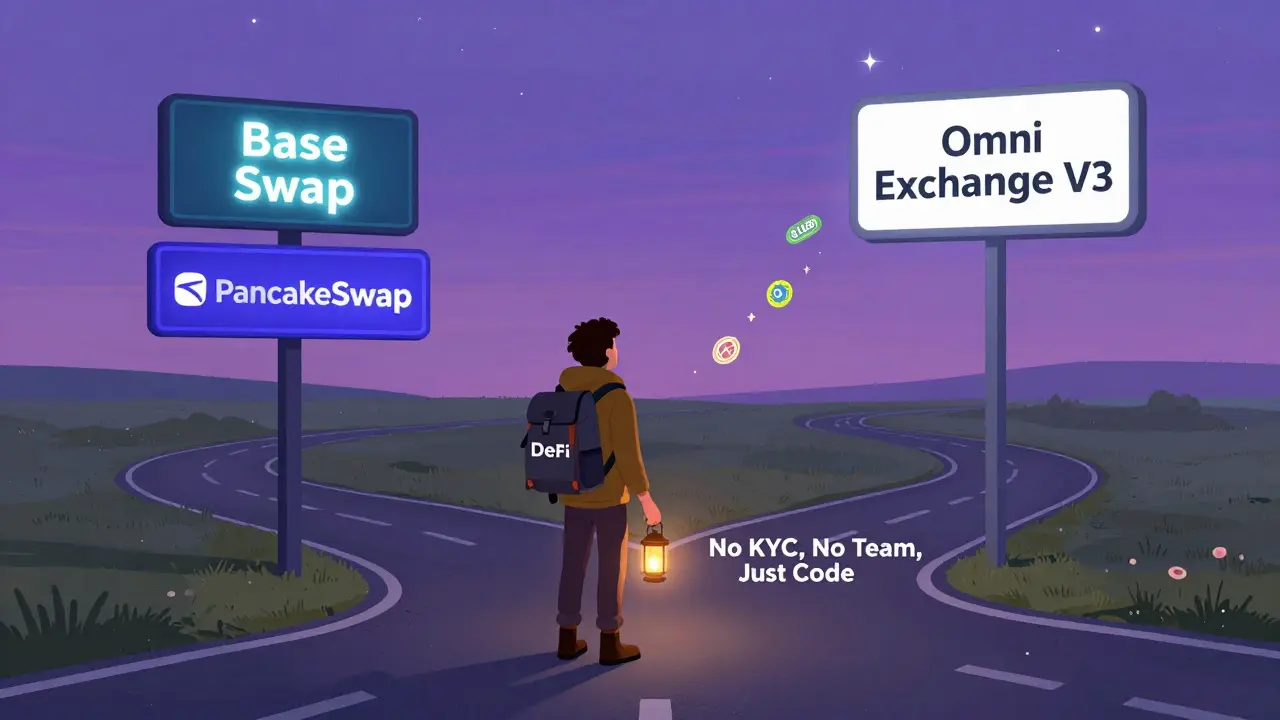

Omni Exchange V3 Crypto Exchange Review: What You Need to Know in 2025

Omni Exchange V3 is a low-fee DEX on Base and BSC with fast swaps and no KYC. But it lacks audits, team info, and support. Best for experienced users trading native tokens, not beginners or security-focused traders.