Hash Rate Explained: What It Means for Bitcoin Mining and Network Security

When you hear about hash rate, the total computational power used by a blockchain network to process transactions and secure the ledger. Also known as network hashrate, it’s the backbone of proof-of-work blockchains like Bitcoin. Think of it like the speed of a factory assembly line — the faster it runs, the more products it can make, and the harder it is for outsiders to break in. A high hash rate means more miners are competing to solve complex math problems, which keeps the network secure and honest.

Without enough hash rate, Bitcoin becomes vulnerable. If a single group controls over half the network’s power, they could theoretically reverse transactions or block others — a scenario called a 51% attack. That’s why the hash rate isn’t just a number; it’s a measure of trust. Every time the hash rate climbs, it signals more miners are betting real money on Bitcoin’s future. When it drops, it often means miners are shutting down rigs because electricity costs more than the coins they’re earning.

Hash rate doesn’t work alone. It’s tied to mining difficulty, the automatic adjustment that makes mining harder or easier based on how much total power is online. Every two weeks, Bitcoin adjusts the puzzle’s complexity to keep new blocks coming every 10 minutes — no matter how many miners join or leave. If hash rate spikes, difficulty rises to slow things down. If miners quit during a price crash, difficulty falls to keep the chain moving. This feedback loop keeps Bitcoin running smoothly without human intervention.

You’ll also see hash rate linked to blockchain security, the resistance of a network to tampering or attacks through distributed computational power. More hash rate = more energy spent = more expensive to attack. That’s why Bitcoin’s hash rate — currently over 800 exahashes per second — is more than the combined power of the top 100 supercomputers on Earth. It’s not just impressive; it’s a financial firewall.

But not all blockchains are built the same. Some use proof-of-stake instead, where security comes from locked-up coins, not raw computing power. That’s why you won’t see hash rate talked about for Ethereum anymore — it switched in 2022. But for Bitcoin, Litecoin, and other proof-of-work coins, hash rate is still the heartbeat.

So when you read that Bitcoin’s hash rate hit a new all-time high, don’t just think "more mining." Think: the network is stronger. Miners believe in it. The cost to break it just went up. And if you’re holding Bitcoin, that’s the kind of number that matters more than the price tag.

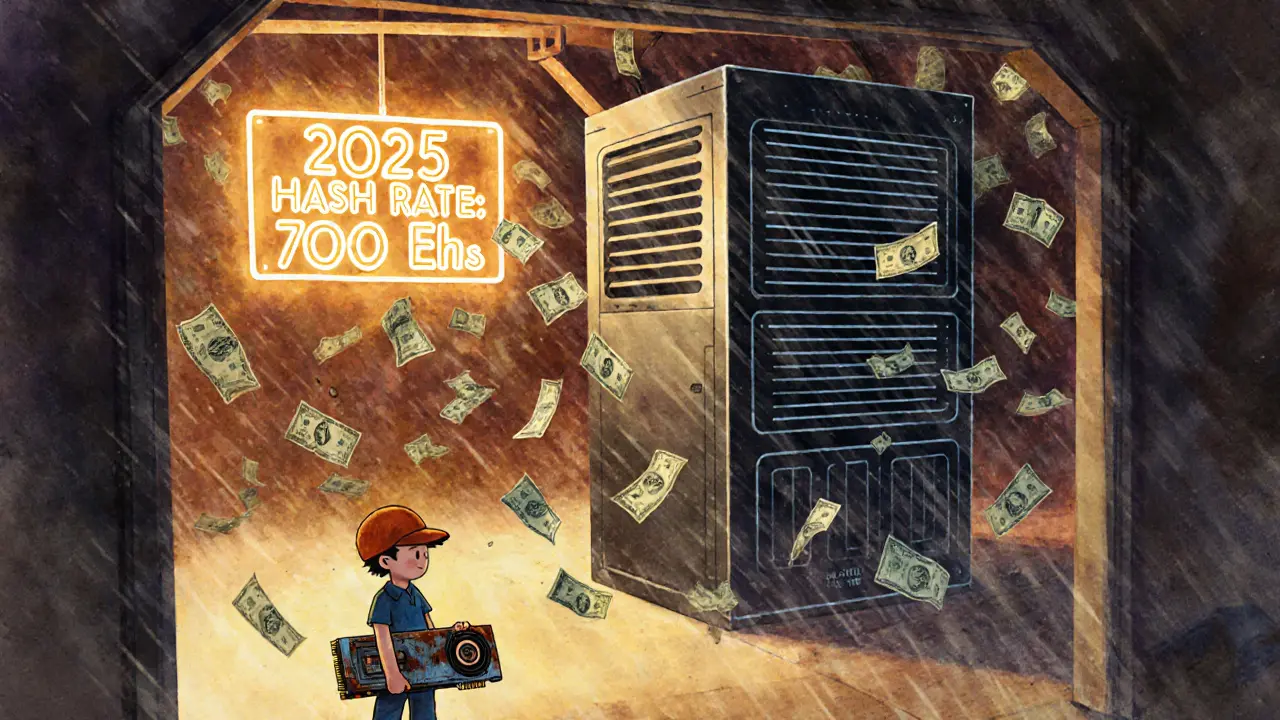

Below, you’ll find real-world breakdowns of how hash rate affects mining profits, why some coins disappear when their hash rate crashes, and how network changes in 2025 are reshaping who still mines — and who’s getting left behind.

Hash Rate and Mining Profitability: How Much You Really Earn Mining Bitcoin in 2025

Bitcoin mining profitability in 2025 depends on hash rate, electricity costs, and hardware efficiency. ASIC miners dominate, but only those with cheap power and modern equipment still make money.