ASIC Miners: What They Are, How They Work, and Why They Matter in Crypto Mining

When you hear about ASIC miners, specialized hardware built to solve cryptographic puzzles for blockchain networks like Bitcoin. These machines aren't your average computers—they're single-purpose powerhouses designed for one thing: mining cryptocurrency as efficiently as possible. Unlike GPUs or CPUs that can switch between tasks, ASICs are locked into one algorithm, usually SHA-256 for Bitcoin. That makes them faster and way more energy-efficient than general hardware, but also useless for anything else.

Bitcoin mining, the process of validating transactions and adding them to the blockchain in exchange for new coins. This is where ASIC miners come in. Without them, mining Bitcoin would be like trying to fill a swimming pool with a teaspoon. The network’s difficulty keeps rising, and only ASICs can keep up. Even then, profitability depends on cheap electricity, cooling, and the right model. Some miners, like the Antminer S19 or WhatsMiner M30S, became industry standards because they delivered more hashes per watt. But they also cost thousands, wear out in 2-3 years, and get replaced fast. And it’s not just about Bitcoin. Some ASICs target other coins like Litecoin (Scrypt algorithm) or Bitcoin Cash (also SHA-256), but most are locked into one. That’s why people talk about mining hardware, the physical equipment used to validate blockchain transactions. It’s a fast-moving market where today’s top model is tomorrow’s paperweight.

What’s often ignored is how ASIC miners changed the whole game. In 2010, you could mine Bitcoin with a laptop. By 2015, you needed a rig with six GPUs. Today, it’s all about warehouse-sized farms with thousands of ASICs humming in sync. Individual miners barely survive unless they team up in pools or find ultra-cheap power. The result? Mining is now dominated by big players with access to cheap energy and bulk hardware deals. That’s why most guides you’ll find here focus on the reality: buying an ASIC isn’t a get-rich-quick move. It’s a high-risk bet on electricity costs, price swings, and tech obsolescence.

You’ll find posts here that dig into real-world examples—like why some ASICs failed hard, how miners track their profits in real time, and which models still make sense in 2025. Some posts even show how mining hardware connects to bigger topics like energy use, regulatory crackdowns, and the shift toward greener blockchains. There’s no fluff. Just facts about what works, what doesn’t, and why so many people lose money chasing mining profits. If you’re thinking about getting into ASIC mining, this collection gives you the raw picture—no hype, no promises, just what’s actually happening on the ground.

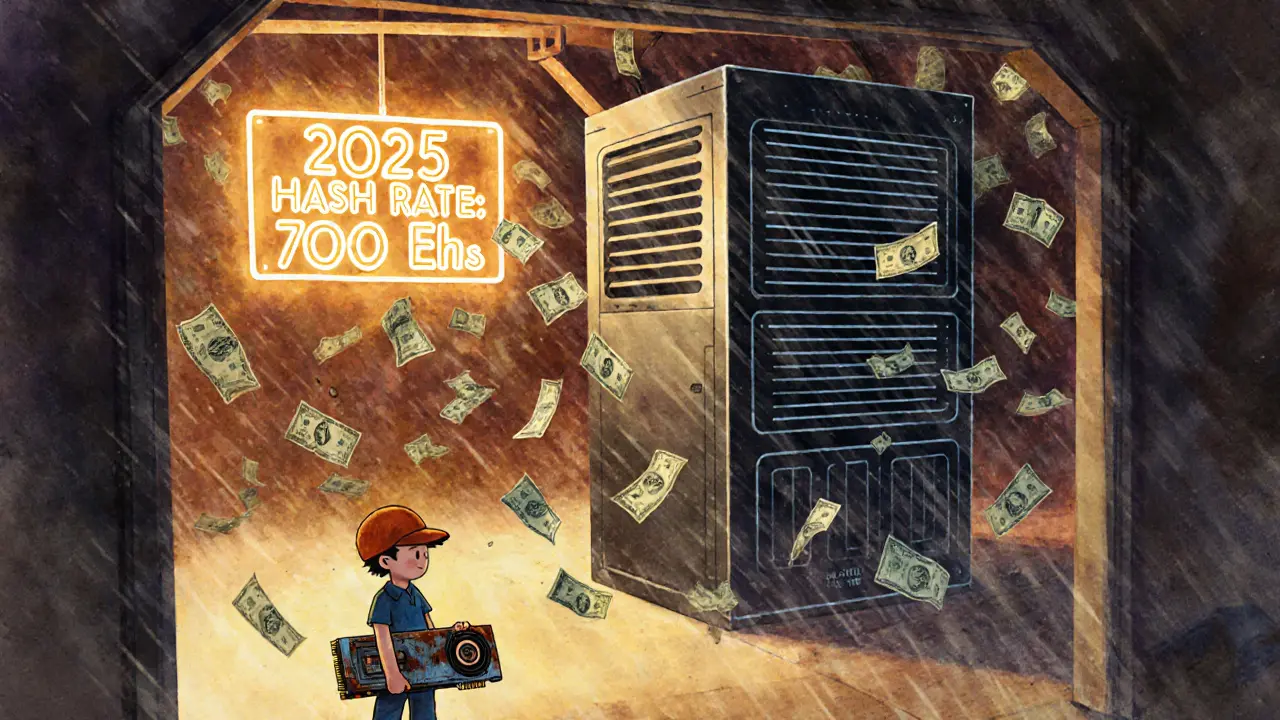

Hash Rate and Mining Profitability: How Much You Really Earn Mining Bitcoin in 2025

Bitcoin mining profitability in 2025 depends on hash rate, electricity costs, and hardware efficiency. ASIC miners dominate, but only those with cheap power and modern equipment still make money.