Electricity Cost Mining: How Much It Really Costs to Mine Crypto

When you hear about electricity cost mining, the amount of power needed to run crypto mining rigs and validate blockchain transactions. Also known as mining power consumption, it's the silent factor that decides whether mining turns a profit or becomes a money pit. It's not just about buying an ASIC miner and plugging it in. The real question is: how much does it cost to keep that machine running 24/7? For Bitcoin alone, the global network uses more electricity than entire countries like Argentina or the Netherlands. That’s not a guess—it’s based on real-time tracking by the Cambridge Centre for Alternative Finance.

Not all coins are equal when it comes to power. Bitcoin mining, the process of securing the Bitcoin network through proof-of-work eats up massive amounts of energy because of its difficulty adjustments and competition. On the flip side, proof of stake, a consensus method that replaces mining with staking uses less than 1% of the energy. That’s why Ethereum switched—and why new projects avoid proof of work entirely. If you’re thinking about mining, you need to know the difference. Your electricity bill won’t care if you’re mining Bitcoin, Ethereum Classic, or Dogecoin. It only cares about watts.

Location matters more than you think. In Texas, where electricity is cheap and abundant, miners flock to warehouses with massive cooling systems. In Iran, where the government subsidizes power, mining exploded overnight—until the grid started failing. In Sweden, miners use renewable hydro power to stay green and profitable. But in places like China, where regulations shut down operations overnight, miners lost everything. Your hardware might be top-tier, but if your power costs $0.15 per kWh, you’re already behind. Most profitable miners operate below $0.06. The tools to calculate this? Simple online calculators that ask for your rig’s wattage, local rate, and hash rate. You don’t need a degree—just a spreadsheet and honesty about your bills.

Hardware efficiency has improved, but not fast enough. The Antminer S19 Pro uses about 3250 watts at full load. That’s like running six hair dryers nonstop. If you’re paying $0.12 per kWh, that’s nearly $10 a day per miner. Multiply that by ten rigs, and you’re looking at $300 a month before you even break even. And that’s assuming the price of Bitcoin stays steady—which it never does. The real winners aren’t the ones with the most rigs. They’re the ones with the cheapest power, the best cooling, and the discipline to walk away when the math doesn’t add up.

Below, you’ll find real-world breakdowns of mining costs, failed projects that burned through power without returns, and the hidden energy traps behind popular coins. Some posts show you exactly how much a single ASIC drains in a month. Others reveal why entire mining farms shut down overnight. This isn’t theory. It’s what happened—and what’s still happening—in basements, warehouses, and data centers around the world.

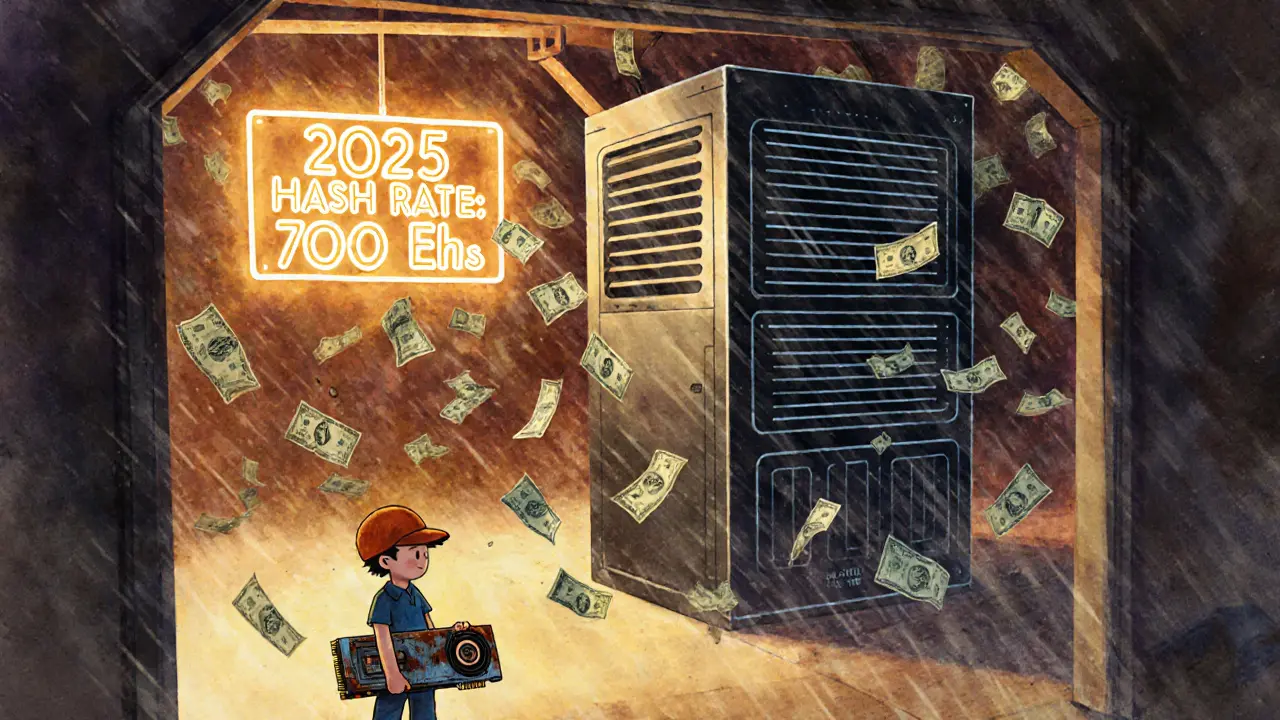

Hash Rate and Mining Profitability: How Much You Really Earn Mining Bitcoin in 2025

Bitcoin mining profitability in 2025 depends on hash rate, electricity costs, and hardware efficiency. ASIC miners dominate, but only those with cheap power and modern equipment still make money.